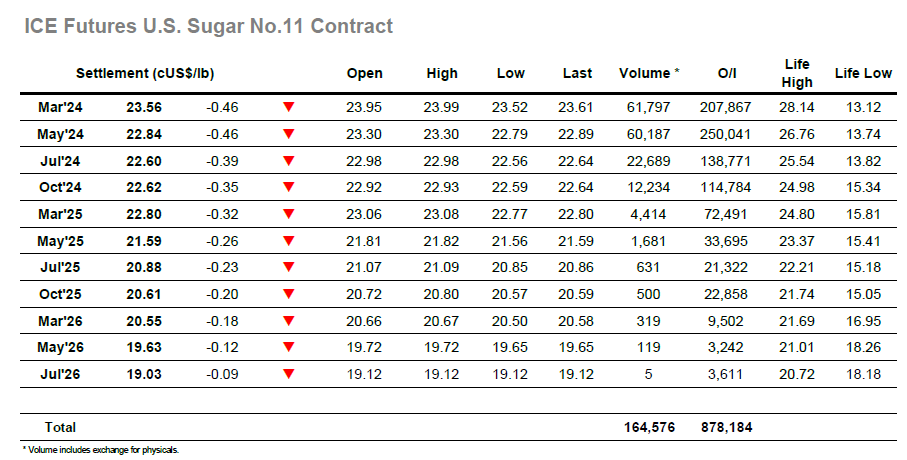

As the index roll moves towards its end and with daily activities moving towards the May’23 contract we turn attention toward that position. The day began negatively with a decline towards 23c, the first couple of hours seeing a low recorded at 23.01 before the market attempted to stabilise ahead of noon. The COT report had as expected shown only small change to the spec position as it ticked a little upward to 27,530 lots long, and so it was no surprise that today’s activities were again being driven by day traders and algos. Recovering to 23.26 as the US day kicked in the market was swiftly placed back under pressure and this time the lower end of the range was extended down beneath 23c. It was really a non-descript showing aside from the continuing spread activities and so the afternoon was spent edging along quietly either side of 23c on low volumes, while March/May’24 had also set back against the rolling and was trading in the low 0.70’s. The only change came during the final stages when traders applied some additional pressure to register a new low at 22.79 and settlement at 22.84. This may lead to additional support testing nearer the recent lows at 22.44 though at present there remains no reason to believe todays action represents anything other than continued rangebound stagnation.

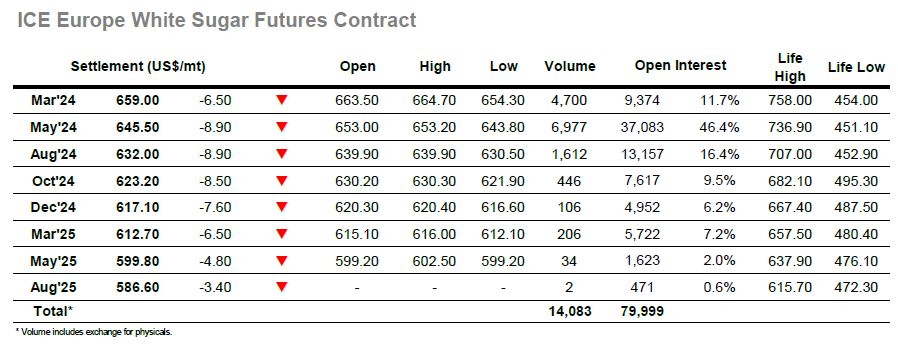

Having failed to break higher last Friday the market began the new week on the back foot with selling placing pressure on May’24 from the start. During the first couple of hours the price fell by more than $10 to $643.80, cementing values within the range and placing pressure upon the white premium values in the process with May/May’24 slipping beneath $137.00. This set the tone for the rest of the day with the recent buying enthusiasm nowhere to be seen, and instead the market was only finding any positive movements against short covering. Progressing along the day was mostly being spent near to the morning lows, and such was the lack of enthusiasm that day traders appeared increasingly disinterested in attempting to force additional movement. March’24 meanwhile was moving through its final few days of trading calmly with steady March/May’24 spread rolling taking place between $10 and $14.90, a still creditable 2.700 lots trading today despite most exposure now having been moved forward. March’24 open interest today stood at just 9,374 lots and with that number set to further decrease once todays activities are incorporated (daily volume was 4,692 lots), suggesting we should see orderly trading into expiry with most traders having now left the front month. May’24 ended the day back around the lows with a settlement made at $645.50, leaving the broad picture unchanged despite the daily losses.