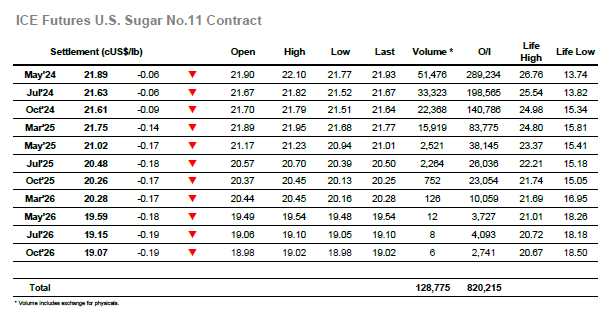

Some light early losses were recorded as grower pricing arrived in reaction to yesterday’s strong performance, though much of the new selling was on a scale basis and so the reaction which drew some profit taking proved to be brief with May’24 finding support in the lower 21.80’s. Before too long the market was working back into credit and into mid-morning the smaller traders started to push from the long side again, successfully taking the price through 22c and on to a high at 22.10. With the technical picture providing additional scope it was surprising that we saw long liquidation send the price back to a new daily low at 21.77 before the morning was through, and though this was gathered up the market then struggled to move back into credit. Following some quiet probing the market did push up towards the morning highs though having reached 22.09 there was some swift liquidation / profit taking which returned values to the range. Here we remained for the last couple of hours to ensure that the market saw only a narrow range, and while this was in stark contrast to the huge range of yesterday it goes some way to cementing the rally and still provides scope for additional near-term gains.

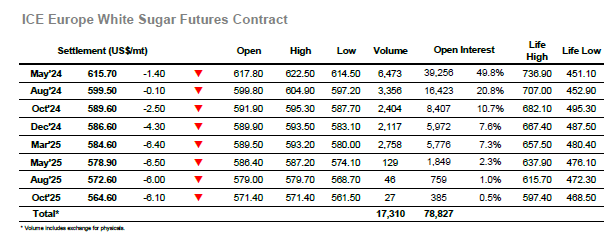

An unchanged opening provided the basis from which to try and forge ahead and it was not long until the market broke above yesterday’s highs and spiked up to $622.50. This pulled the May/May’24 white premium back up to $136.00 but though efforts were made to maintain the higher levels there was only a limited amount of buying coming in and a correction into the range followed. With the market struggling to find a great deal of direction and activity being driven by smaller traders there was some exploration around the range resulting in a dip to $614.50, though the picture was otherwise quiet. The afternoon saw nearby positions looking to climb back up through the range, though down the board there were some stark differences being seen with idle/forward positions valued up to $10 lower to widen spread values significantly. Notwithstanding this, May’24 activity remained quietly steady within the range as a slow afternoon saw it move back toward the highs before falling back down the range late on. This left it closing a touch lower at $615.70 while May/May’24 was back around $133.00, a fair conclusion to a mundane session which ultimately served to consolidate yesterday’s rally.