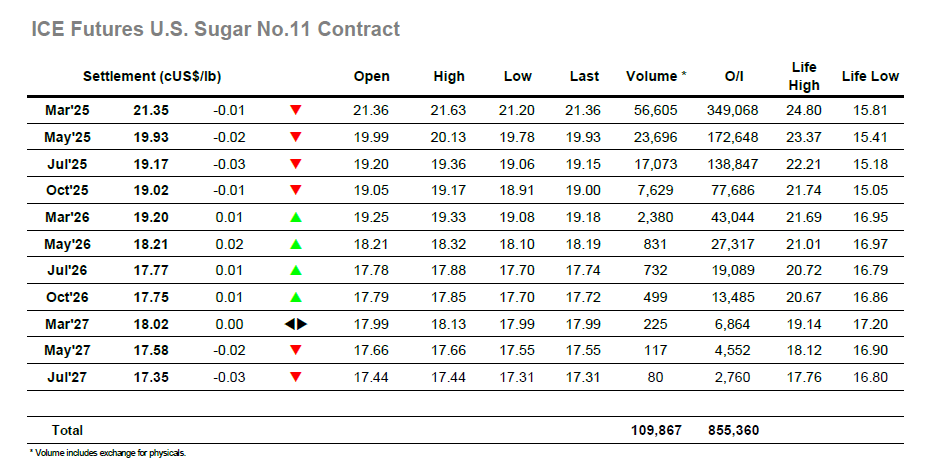

An unchanged opening was short lived, and the market was soon working lower again to sit within 10 points of the initial support provided by yesterday’s lows. The morning then saw calm trading with prices tracking along in front of this mark, very little occurring as traders looked to stabilise and prevent a continuation of yesterday’s losses which lacking any significant buying with which to do so. By the early afternoon March’25 had managed to build back up to 21.49 and sit in credit, however the rally halted with the publication of slightly better than expected UNICA figures for the second half of October. These showed cane 27.167 mmt / Sugar 1.785 mmt / Mix 46.12% / ATR 149.48 kg/t / Ethanol 1.641 mlt, and the market shot back to 21.20 and matched the earlier low in reaction before making a sharp turn and rallying back up as the sellers turned and sought cover. The recovery was stronger than the fall with highs made at 21.63, however it was not sustained and so by late afternoon the gains were partially erased with the price sitting in the upper 21.40’s. Small traders were keen to find technical opportunity and sold March’25 back down during the final 30 minutes, resulting in a close at 21.35 and while this represented an inside day for the chart the sentiment remains negative moving into tomorrow.

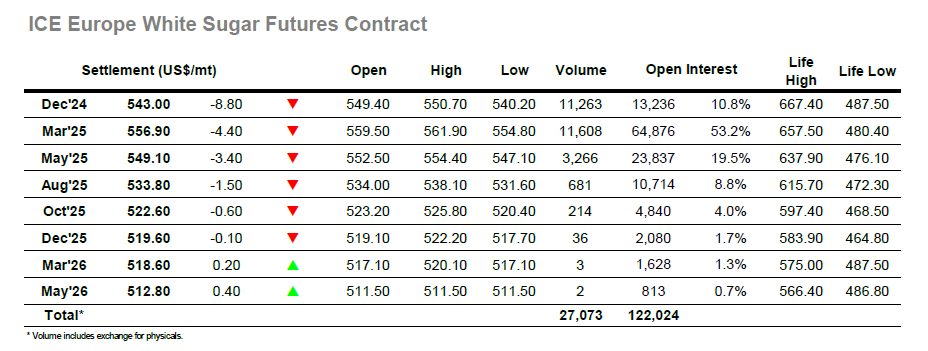

March’25 immediately dropped back beneath $560 as we opened and during the early part of the morning relied upon consumer pricing ahead of yesterday’s lows to provide support and prevent prices from falling further south. Some brief respite as provided from small trader covering but until noon the price action was mostly focussed to the bottom of the range with little sign that yesterday’s negative technical action could be shaken off. Small efforts were made during the early afternoon to stabilise the market again, but these were driven by specs and as soon as they stopped buying / looked to close longs the market hit the skids, dropping quickly to $554.80 before then making an about turn and flipping the traders out to the opposite side also on its way back up. This really summed up the flat price with the lack of any sizable interest from the trade still leaving it vulnerable to these intra-day swings and providing little encouragement to those without hedging requirements to become involved. There was another steady spread volume for Dec’24/March’25 as we edge nearer to expiry, though today it was the sellers in the driving seat with the value falling beneath -$15.00. The charts encouraged sellers back in during the later stages and sent the market out around the bottom of the range, with March’25 settlement at $556.90 likely to encourage more support testing.