Having eased back yesterday the market encountered some light support versus physical activities when we resumed, enabling values to rally by more than 20 points during the early stages against limited volume. The Oct’24 price extended to 18.56 before a period of calm emerged, though there was no hint of pullback with the market simply holding the 18.50 area. Another wave of buying followed early in the afternoon with this effort moving Oct’24 further ahead t0 18.70, just 3 points shy of yesterday’s high mark, though liquidation followed, and the price returned to 18.50 once more. There was a period of calm into the afternoon as the latest UNICA announcement neared, with its publication revealing Cane at 51.316 mmt / Sugar 3.61 mmt / Mix 50.28% / ATR 146.86 kg/t / Ethanol 2.549 mlt, providing a sugar figure largely in line with estimates despite a slightly lower than anticipated mix. The immediate reaction was a fall back to 18.30 however there was supportive scale buying starting to show from overnight levels and so a period spent holding this mark eventually gave way to some short covering and a recovery into the range. The final part of the day played out at the lower end of the range though the lows were not again threatened, eventually leading to a close at 18.39 to conclude an inside chart day.

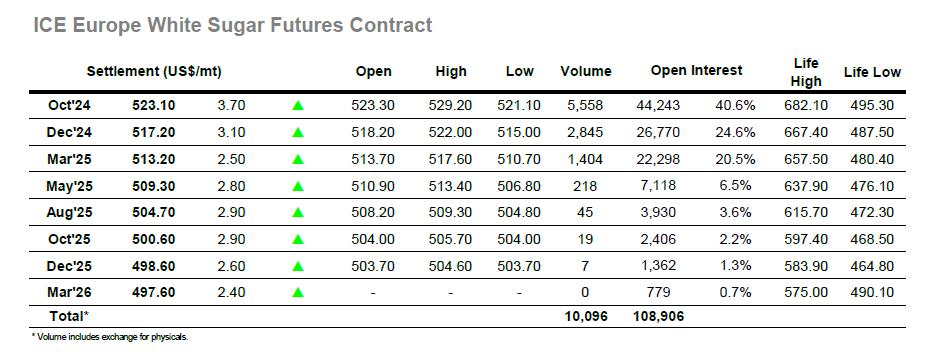

Oct’24 whites jumped higher as we opened and found a slow but steady stream of buying through the first hour to progress the price up to $526.00. On thin volume the price continued to flit around through the morning with a slight upward bias, building on this soon after noon when a more concerted burst of buying arrived to send the price through to $529.20. Selling was in place ahead of yesterday’s highs and so some short covering followed to push the price back down through the range, its impact being quite significant due to the lack of resting orders as we swing around. New lows followed at $521.10 though it was of little significance with the conditions lending themselves to a range bound session. White premiums did see some movement intra-day with the Oct/Oct’24 working towards $119.00 for a period, while for the spreads we saw Oct/Dec’24 out to $7.40 intra-day though like the flat price this movement was not made on any significant size. The last couple of hours were spent in the lower/mid $520’s, consolidating a degree of the gains but without looking particularly impressive as Oct’24 ended at $523.10.