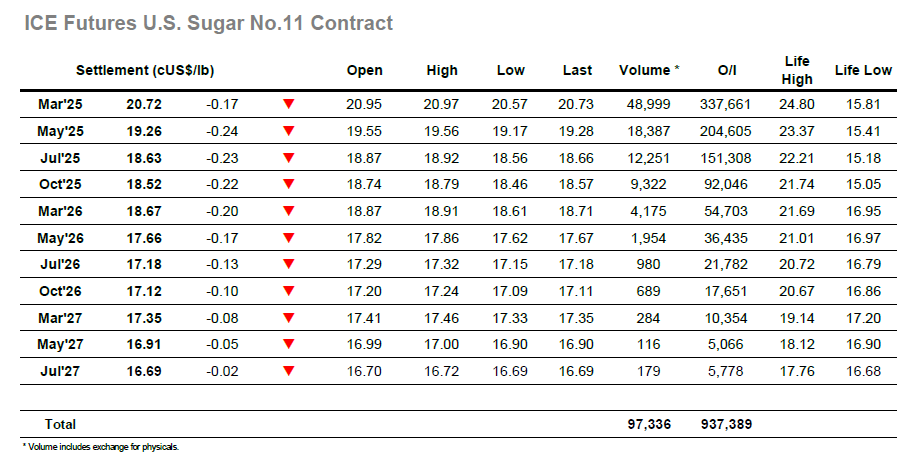

The market pushed up to 20.97 during the opening minutes but with this week seeing a consistent amount of support testing the price soon slipped back into deficit with March’24 sitting in the low 20.80’s. There was another push lower later in the morning which dropped the price down to 20.72, placing the contract just 2 points in front of the recent lows and opening it up to more spec pressure when those in the Americas reached their desks. It did not take long for the selling to build and break through 20.70, and while the first push just provided a brief spike down the pressure remained across the following hours to slowly grind through scale buying and record daily lows at 20.57. Volume suggested that the selling was predominantly from smaller specs / algos, with producers showing no interest at the lower levels despite the USDBRL moving back over 6.00. The final ninety minutes did bring through some position covering to bring prices away from the lows, and though there was a desire amongst those who remain short to push values as low as possible ahead of the weekend the final minutes saw additional covering. This led March’25 to settle at 20.72, a still negative close but less so than would have been the case had it ended beneath 20.70.

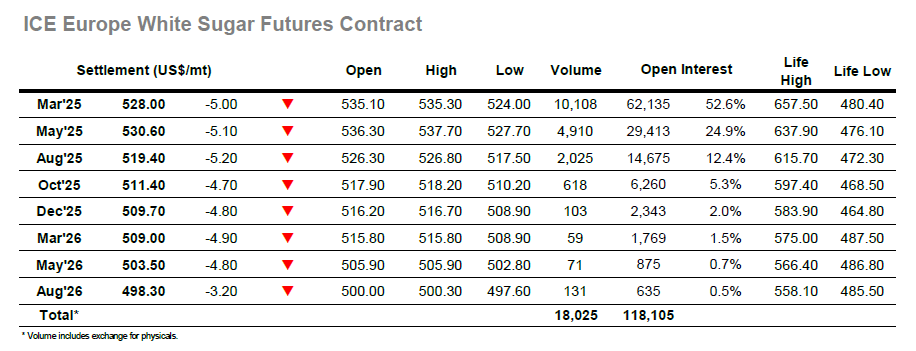

Opening buying generated initial prints above $535.00 but mixed trading was to follow with the market trading across the lower $530’s through to mid-morning. At this stage, the downward pressure picked up again with movement taking the price through $529.40 to yet another 3-month low, and while buyers continue to pick away there remains no news and as such the technical picture continues to dominate. With prices breaking fresh ground, the slow but steady pressure endured well into the afternoon and eventually registered session lows at $524.00, though down the board losses were more limited with assorted pricing providing more resilience in areas where there was far less selling / liquidity. One consistent factor in the market of late has been that the moves have met with some respite along the way, and there was a degree of this through the later afternoon as pre-weekend position covering brought prices back up a small way from the lows. The net result of this was a close for March’25 at $528.00, still appearing vulnerable to the downside with little on the chart to suggest that any bounces will not simply be providing near-term respite. Nearby white premiums remain near their lows with March/March’25 valued at $71.20 while the March/May’25 spread closed at -$2.60.