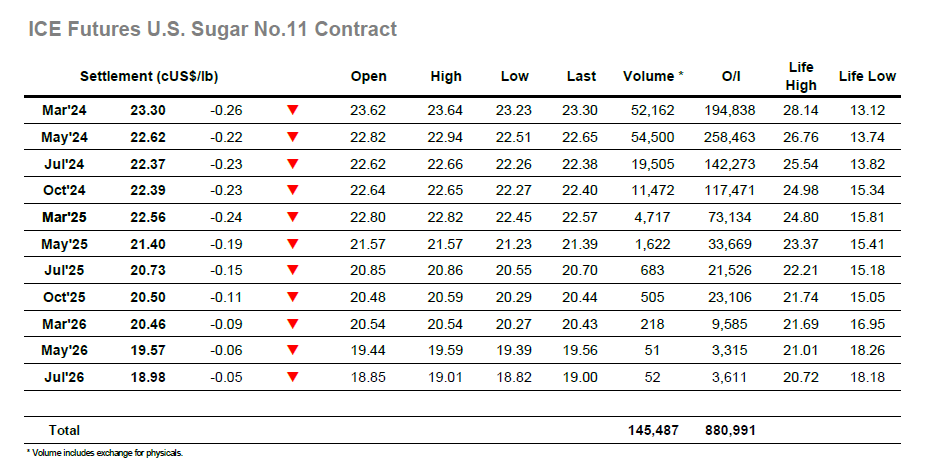

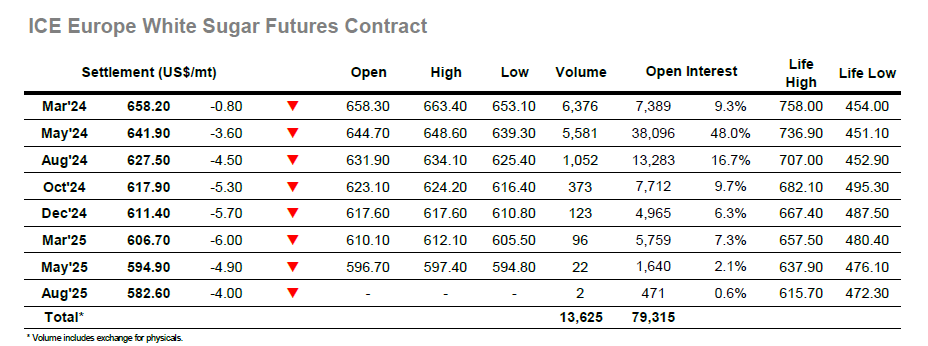

It was another weak start for May’24 as early trading saw the price slip back to 22.68 before some defensive buying kicked in. This enabled the market to gradually claw its way back from the lows and while trading remained very slow on low volumes there was sufficient interest to have the market trading around overnight levels by late morning. Marginal new daily highs were seen around noon however they proved to be short lived as the market soon worked back down through the morning range. This in turn led to additional losses during the afternoon with smaller specs seeming to be more comfortable with playing the short side and lows were recorded at 22.51. As so often there was a sharp covering rally to quickly emerge from the extreme of the range and this took the price back to mid-range, leaving May’23 edging back along in the region of 22.70 as we moved into the final hour. March/May’24 had meanwhile been seeing the last of the index roll take place and with the flat price lower the spread was also under some pressure and reached a narrowest 0.66 points with settlement only just above this level. The close saw a little more selling emerge and push prices back down the range, which ensured a weaker close for May’24 at 22.62 and brings last week’s recent low mark of 22.44 back into view.  May’24 whites followed the lead from No.11 to trade lower during the early stages and saw a sharp drop to $640.20 before stabilising. A morning of calm consolidation then developed with the market pulling back up to a small credit, though the thin nature of the volume was apparent during late morning when May’24 gave back a few dollars on just 100 lots before making an about turn and recovering to a daily high $648.60. The recovery could not last though and sentiment once more became the driver with recent upside failures now encouraging the smaller traders to test the underlying support. Their efforts sent values through the earlier lows with May’24 reaching $639.30, though that remains almost $7 above last week’s low mark and reflects a firming of the white premium with May/May’24 trading around $143.00. A short covering move did see the market briefly touching back to unchanged levels however while the specs view any opportunity to the lower end of the range there was a return of selling ahead of the close. This left May’24 settling at $641.90 though whether that acts as a stop on the way to challenging the lower $630’s remains to be seen.

May’24 whites followed the lead from No.11 to trade lower during the early stages and saw a sharp drop to $640.20 before stabilising. A morning of calm consolidation then developed with the market pulling back up to a small credit, though the thin nature of the volume was apparent during late morning when May’24 gave back a few dollars on just 100 lots before making an about turn and recovering to a daily high $648.60. The recovery could not last though and sentiment once more became the driver with recent upside failures now encouraging the smaller traders to test the underlying support. Their efforts sent values through the earlier lows with May’24 reaching $639.30, though that remains almost $7 above last week’s low mark and reflects a firming of the white premium with May/May’24 trading around $143.00. A short covering move did see the market briefly touching back to unchanged levels however while the specs view any opportunity to the lower end of the range there was a return of selling ahead of the close. This left May’24 settling at $641.90 though whether that acts as a stop on the way to challenging the lower $630’s remains to be seen.

Daily Market Price Updates and Commentary 13th February 2024

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.

Related content

Daily Market Price Updates and Commentary 14th April 2025

Raw Sugar Update The week commenced with Jul’25 still sitting at...

Sugar Futures and Market Data: 14th April 2025

Insight Focus The raw sugar futures traded lower last week. Both produ...

Dry Weather Aids EU Beet Plantings

Insight Focus European beet plantings are happening rapidly. They’ve...

Daily Market Price Updates and Commentary 11th April 2025

Raw Sugar Update It was with some relief that the market posted a calm...

Daily Market Price Updates and Commentary 10th April 2025

Raw Sugar Update After yesterdays close the news of the latest Tariff ...

CS Brazil: Sugar or Ethanol? 9th April 2025

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 9th April 2025

Raw Sugar Update Following yesterday’s weak technical showing the ...

US Sugar Market Finds Some Support in Tariffs

This update is from Sosland Publishing’s Sweetener Report. For more ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...