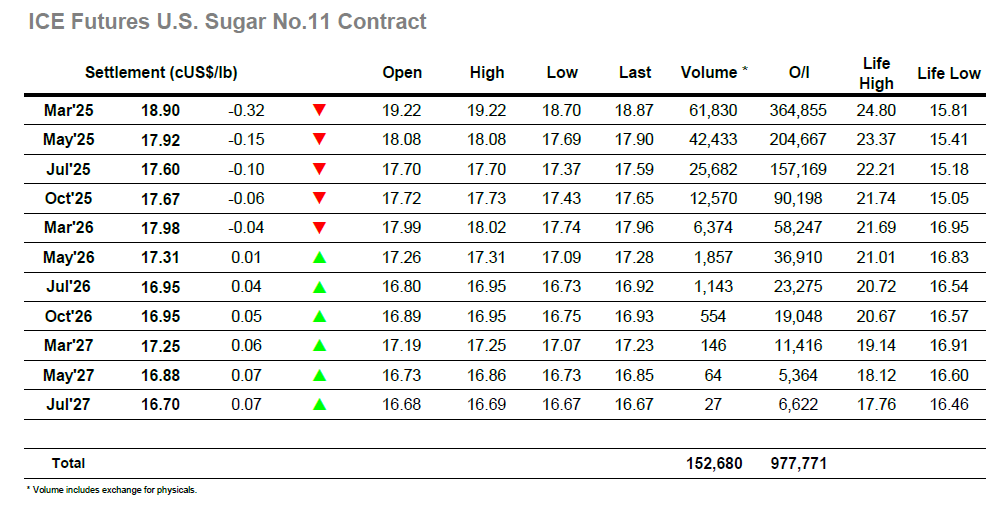

It was a case of “as you were” when trading resumed from the weekend as March’25 encountered some immediate pressure and dropped back towards 19.00. There was some mild support in place from consumer/end user pricing orders which was able to limit any additional losses through a low volume morning, however with the buying filled in the market started to creak ahead of the US morning and headed south to test last weeks lows. These were quickly broken to trigger some stops and slightly heavier selling as March’25 touched down to 18.70, though as the market levelled back out some short covering followed behind. Moving through the early afternoon the picture calmed down with the spot month swinging either side of 19.00 without on small trader activity without challenging the established parameters, a pattern which endured right the way through to the close as even the small traders reined in their risk. There was movement in the spreads which will have encouraged the bears however, with March/May’25 taking a beating and ending the session at 0.98 points, the first-time trading back beneath 1.00 points since mid-September. With March’25 closing at 18.90 this spread value will provide encouragement to the shorts that the slide is not yet over as eyes turn to tonight’s delayed COT report.

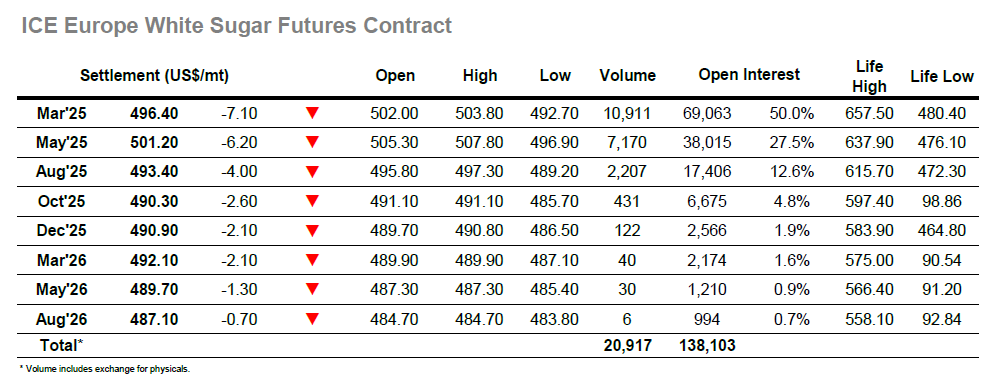

There was a better than anticipated opening which saw March’25 briefly trading around unchanged, however with No.11 already trading lower the market soon tracked lower to find itself nestling beneath $500. Initial support as being found at last Thursdays $495.10 low mark and with assorted pricing orders generating some support the market was able to hold ahead of this mark through a quiet but unconvincing morning period in which the lows remained the focus. All remained the same until noon when a small push lower tested and broke this initial support with the range extending to $492.70 before defensive buying and day trader covering arrived to nudge the price away again, although the recovery was unconvincing, and the price remained beneath $500. Any hopes that the Americas may add to the momentum came to nothing as the afternoon saw the market holding an ever-smaller band in the mid-$490’s, dull but the kind of activity which will only encourage the bears in their belief that we can see more new lows. The slow afternoon ended with March’25 settling at $496.40, and while the nearby premium continues in its same are at $79.75, the spreads were weaker with March/May’25 closing just off its lows at -$4.80.