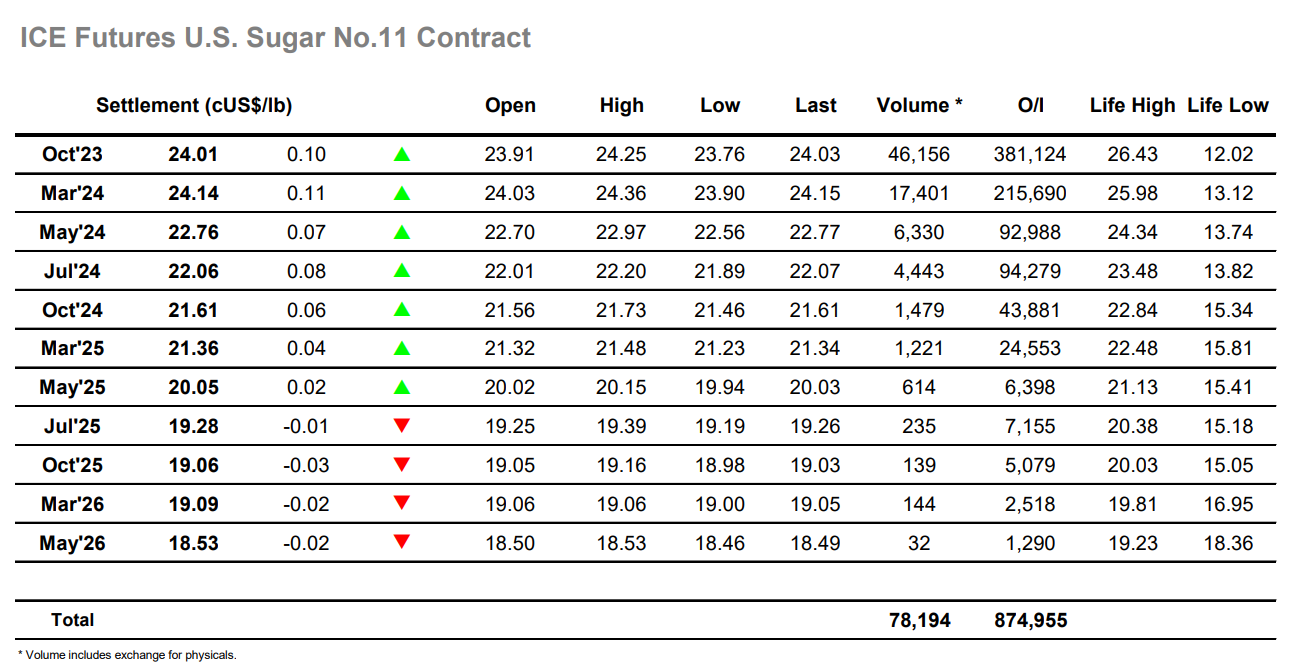

No.11 has performed positively to reach 24c this week, but despite the potential to continue the push and generate some new technical momentum the price action proved to be subdued through the morning. Through the first few hours Oct’23 held a tight 23.83 / 24.00 band, still well placed to try higher but lacking the necessary volume to break through the selling in place. Things soon changed as we ticked past noon with the specs suddenly finding some appetite to push on, and it quickly achieved results with buying following in from various specs/algo’s to take Oct’23 on to 24.25 before stalling. The lack of any trade / consumer interest then showed with a sharp pullback to 23.80 on liquidation, a worrying sign for the specs that they are perhaps attempting to drive the market higher before it is ready to oblige. With the specs then retreating the picture calmed significantly to again hold a narrow band beneath 24c, and this was maintained for most of the afternoon with new lows at 23.76 recorded during the final hour. Specs then reappeared to dress the market aggressively during the closing stages in search of a positive settlement level for the charts, just about achieving one with an Oct’23 close at 24.01 though whether this will be sufficient to convince other potential buyers to the market at this stage remains to be seen.

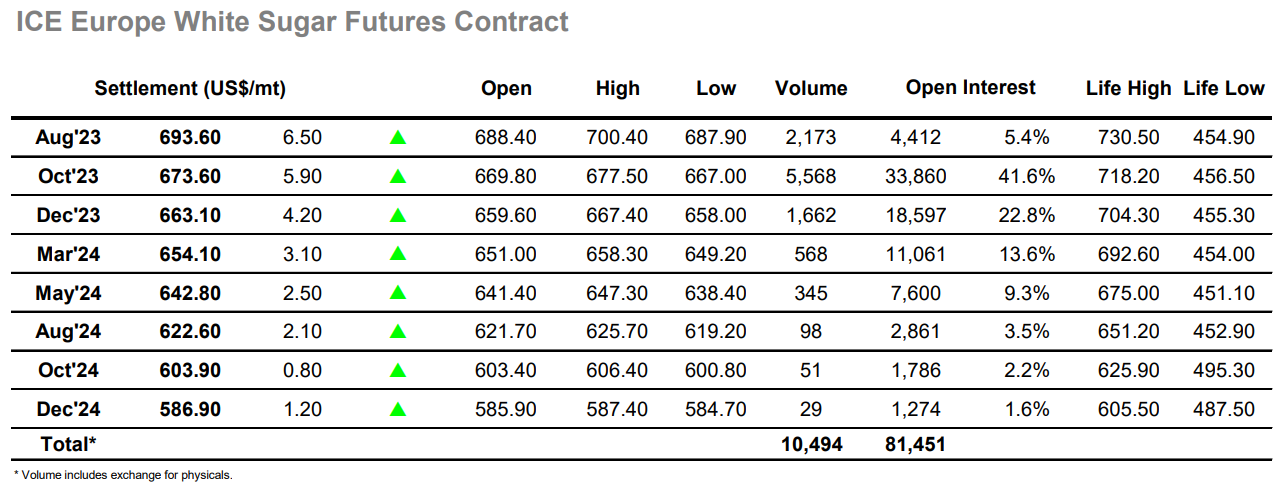

Recent days have seen the whites resurgent, and continuing to be motivated by the front month squeeze there was again buying on show this morning to start steadily. A brief dip to $667.00 followed however the mood remained positive and so by late morning we were seeing Oct’23 making new highs at $673.00. This provided a good base from which the specs could continue to play the technical picture and push higher again, their efforts yielding further success with a rally to $677.50 though on this occasion there was no stabilisation at the top. Instead, the market saw a sharp decline all the way to unchanged against the subsequent long liquidation, the first sign that consumers were not following the move and perhaps suggesting that we may be reaching a short-term top. The movements had also widened out the white premium values once more, Oct/Oct’23 moving towards the mid $140’s and remaining there even after the decline as Oct’23 calmed either side of $670.00. Aug’23 meanwhile remained firm with the flat price touching above $700 on the rally while Aug/Oct’23 sat quietly in the $21 area. The afternoon calm was only broken during the final 30 minutes as spec buyers returned to push Oct’23 sharply back up through the range, achieving another positive settlement level of $673.60 as they look to continue building the recent momentum.