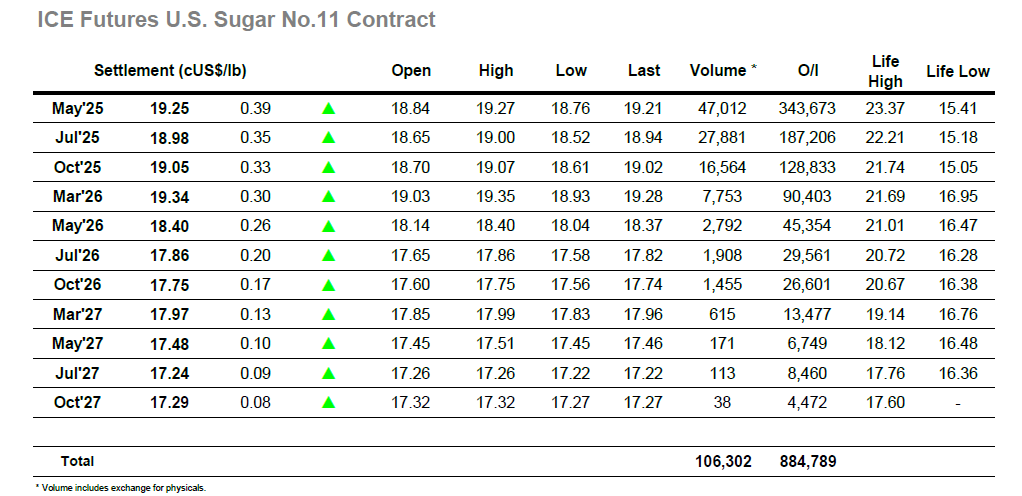

It was a subdued start to trading as last night’s late retreat had traders re-questioning the upside merits with the early period spent treading water either side of last nights closing levels. That the market did not fall below 18.765 was clearly then interpreted as a positive by the smaller traders as mid-morning saw them generate some fresh buying and again push the market into the start of the grower pricing that rests above 19.00 to see whether additional progress can be made. The move stalled a few points shy of yesterday’s 19.12 mark however the next movement made around noon extended the recent gain to 19.15, although the fresh highs again failed to yield much new buying leaving the progress somewhat stuck. The rest of the afternoon saw a good deal of resilience against modest volume with prices only dipping as far as the higher 18.90’s with the upper end of the range consolidated, but all the while struggling to forge ahead as the bulls would wish. News of the latest Datagro analysis for the Brazilian crop was keeping the market from falling back too far and the final stages then saw buying return which pinged the May’25 contract to new weekly highs at 19.27 and reinforced the current technical recovery. Closing values were only just shy of this mark at 19.25, placing the market in a solid position heading to tomorrow.

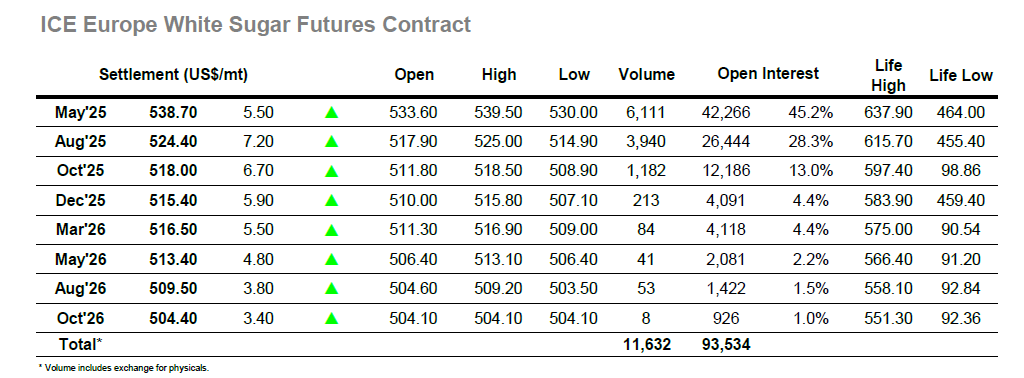

May’25 continues to play out a similar band this week with initial trading this morning seeing a fall to $530.00 before digging in and moving back into credit across the first 90 minutes. Momentum then continued to gather with more spec buying pushing May’25 easily up through the thin environment to reach $539.50, within 0.50c of yesterdays high and well positioned to try and continue the current rally. The higher efforts continued into the afternoon however they were unsuccessful in uncovering the level of buying required to maintain a gain and so trading then settled down to consolidate the higher levels in a slow and tedious way. While remaining steady this same pattern endued throughout the afternoon with the market remaining steady but at no stage managing to make it beyond $540.00 and achieve new recent highs. Despite a late rally for No,11 values there was no reaction by the whites and so the white premium suffered a late blow with trades back down to $115 in May/May’25 despite the outright sitting to the top of the range. A close at $538.70 leaves the market still well situated to continue upward, despite the premium suggesting a degree of caution.