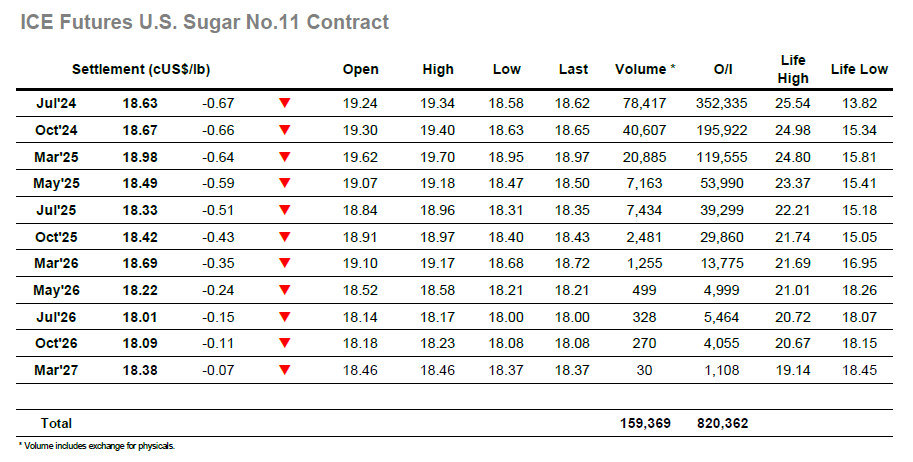

It was an underwhelming start to the week as Jul’24 traded either side of unchanged during the early stages, hinting at a continuation of recent sessions and continued rangebound trading. Fridays COT report showed little change across the 5-day reporting period with the speculative sector now showing as -47,685 lots short, and with no other news the morning settled into an increasingly tight range centred around 19.20. The calm ended as the arrival of US traders drew selling which looked to test last months 18.97 low, the specs clearly keen to continue investigating lower to benefit their own holdings, possibly motivated by the losses being seen for coffee, and particularly for cocoa. A small effort to hold above 19c was unsuccessful and as the previous lows broke there were a host of sell stops triggered which sent the price in a straight line to 18.73. A short covering rally only extended 18.94, underlining the technical break, and the price action then moved back towards the lows with buyers only being seen on a scale down basis. This generally held the market in check although marginal moves to new lows were seen with Jul’24 touching to 18.70. The final quarter of an hour saw some more aggressive selling emerge as shorts looked to maximise the impact of the move on the charts, leading to a Jul’24 settlement at 18.63 and lows of 18.58 and may lead to additional weakness when we resume tomorrow.

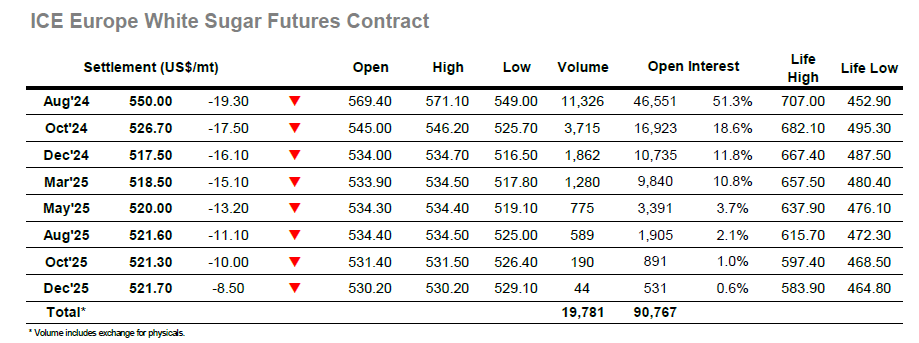

Despite trading to $571.10 on the opening there was little buying to be seen for the whites this morning which led values to start drifting. Volume was limited from both sides although following last week’s upside failure it was the short side which looked to be being played by smaller traders to leave Aug’24 in the mid $560’s by late morning. There was little change to this pattern through the early afternoon until the No.11 market came under pressure, leading the market to shoot through $560.00 as the drag factor told. Through this period there was significant fluctuation for nearby white premium values with Aug/Jul’24 trading up above $146.00 and then back to the lower $140’s as the whites slid lower. Key support was being seen at last months $555.80 low mark, and for a couple of hours this level provided ample support until the weight of movement elsewhere (both Cocoa and Coffee were falling, as well as No.11) led to that level being broken. Volumes were not significant on the break, indicating that few stop orders were in place, though selling continued to kick through and removed any chance of recovery. Reaching the close Aug’24 had fallen beneath $550, while the arb had slumped beneath $139, a remarkable contrast to recent weeks which will test the resolve of any longs. Aug’24 settled at $550.00 before trading to $549.00 on the post close, though the uniform nature of decline left Aug/Oct’24 only mildly changed at $23.30.