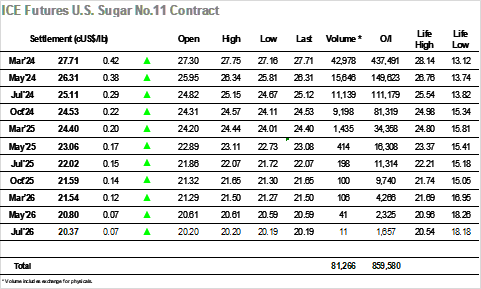

An opening dip to 24.16 saw March’24 trading at its lowest price since 2nd November, and while there was sufficient consumer interest in play to prevent the price from falling any further the morning saw the market struggle to move far from the upper teens. Since making contract highs at 28.14 the market has swung consistently within the “27’s” and this trend looked set to continue as the arrival of the US specs drew buying which pushed the price up to 27.42. There was no immediate continuation from the specs however as the afternoon progressed so for a period the market drifted in the 27.30’s before boosting up to new highs as a second wave of buying arrived. This move extended the gains to 27.64, and with resistance only light due to a lack of producer interest there was another period of consolidation in the run-up to the close with smaller specs content to support their efforts and maintain the move. Such efforts provided the platform for one final upward effort moving into the closing call, where q few thousand lots of buying ensured a positive settlement at 27.71 while highs were registered at 27.75. This remains shy of the levels seen late last week where a little more resistance would be expected, though with no fresh news and the specs playing the longs side another look towards 28c would appear likely.  The new week got off to a slow start with March’24 chopping around in the mid $730’s on light volumes, looking to dig in and hold around last week’s lows to prevent the risk of a fall. Though the outright volumes were nothing to write home about there remained some stead activity for the Dec’23/March’24 spread ahead of Wednesday’s expiration with the value pushing up a little as the rolling continues. This pattern maintained into the early afternoon when some outright buying emerged in conjunction with No.11 to send the price to $740, ensuring that the flat price stability was more comfortably maintained. This in turn drew some more buying in as the afternoon moved along and took March’24 to a high at $745.40, exceeding the gains being made for No.11 and so widening the March/March’24 white premium out towards $137.00. These outright gains were consolidated as we moved along through the final two hours to ensure that a solid performance would be recorded, leading to some MOC buying a new high at $746.00, with settlement made just beneath this mark at $745.70. The Dec’23 open interest stands at 9,240 lots as at last Friday, with todays volume of 6,462 lots expected to further reduce this figure as we move towards expiry. Dec’23/March’24 concluded the day only moderately higher at $10.60.

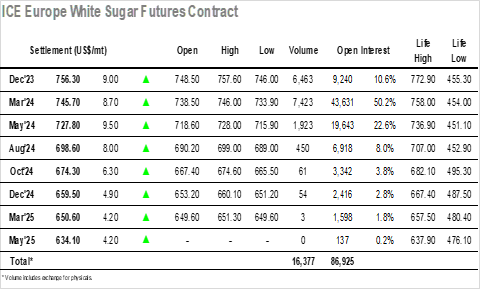

The new week got off to a slow start with March’24 chopping around in the mid $730’s on light volumes, looking to dig in and hold around last week’s lows to prevent the risk of a fall. Though the outright volumes were nothing to write home about there remained some stead activity for the Dec’23/March’24 spread ahead of Wednesday’s expiration with the value pushing up a little as the rolling continues. This pattern maintained into the early afternoon when some outright buying emerged in conjunction with No.11 to send the price to $740, ensuring that the flat price stability was more comfortably maintained. This in turn drew some more buying in as the afternoon moved along and took March’24 to a high at $745.40, exceeding the gains being made for No.11 and so widening the March/March’24 white premium out towards $137.00. These outright gains were consolidated as we moved along through the final two hours to ensure that a solid performance would be recorded, leading to some MOC buying a new high at $746.00, with settlement made just beneath this mark at $745.70. The Dec’23 open interest stands at 9,240 lots as at last Friday, with todays volume of 6,462 lots expected to further reduce this figure as we move towards expiry. Dec’23/March’24 concluded the day only moderately higher at $10.60.

Daily Market Price Updates and Commentary 13th November 2023

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.

Related content

Daily Market Price Updates and Commentary 14th April 2025

Raw Sugar Update The week commenced with Jul’25 still sitting at...

Sugar Futures and Market Data: 14th April 2025

Insight Focus The raw sugar futures traded lower last week. Both produ...

Dry Weather Aids EU Beet Plantings

Insight Focus European beet plantings are happening rapidly. They’ve...

Daily Market Price Updates and Commentary 11th April 2025

Raw Sugar Update It was with some relief that the market posted a calm...

Daily Market Price Updates and Commentary 10th April 2025

Raw Sugar Update After yesterdays close the news of the latest Tariff ...

CS Brazil: Sugar or Ethanol? 9th April 2025

This report is updated weekly, for daily information refer to our Busi...

Daily Market Price Updates and Commentary 9th April 2025

Raw Sugar Update Following yesterday’s weak technical showing the ...

US Sugar Market Finds Some Support in Tariffs

This update is from Sosland Publishing’s Sweetener Report. For more ...

Want to learn more about Sugar

The Raw Sugar Futures July-October Spread

Welcome to the sixth instalment of Czapp’s course on futures market ...

The Raw Sugar Futures May-July Spread

Welcome to the fifth instalment of Czapp’s course on futures mar...

The Raw Sugar Futures March-May Spread

Welcome to the fourth instalment of Czapp’s course on futures market...

The Raw Sugar Futures October-March Spread

Welcome to the third instalment of Czapp’s course on futures market ...

Biomass: The Future of Renewable Energy

What is Biomass? Biomass is a fuel derived from organic material such ...

What Factors Influence Futures Market Spreads?

Welcome to the second instalment of Czapp’s course on futures ma...

Identifying Relationships in Commodities With Machine Learning

Insight Focus We have used machine learning to research commodity mark...

What is the Carbon Border Adjustment Mechanism?

Insight Focus Importers of carbon-intensive materials to the EU will p...