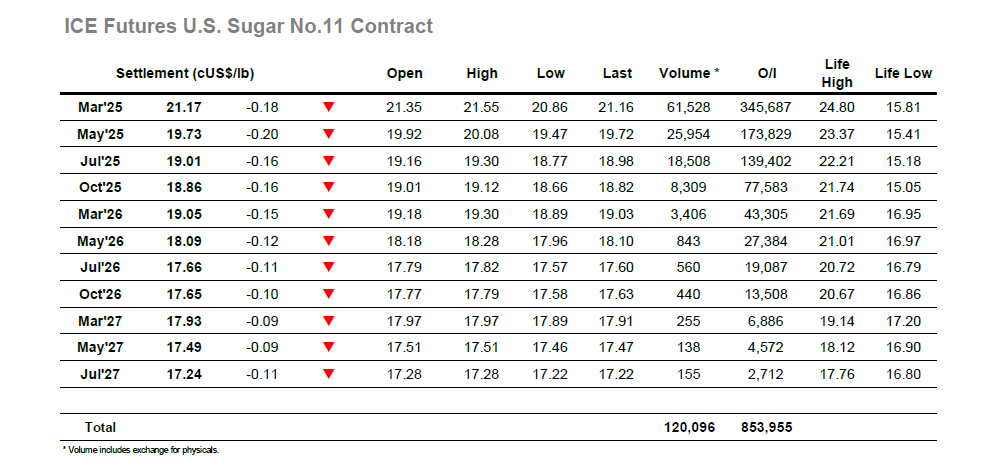

Initial hedge lifting sent March’25 as high as 21.55 during the early part of the session, and the market retained some of this stability through the morning as prices dug in to hold ahead of 21.40. It was only as the morning ended that some selling pressure started to be applied and sent prices back to a small deficit, with the losses then slowly growing over the next couple of hours to test the recent 21.12 low. This level held upon its first test before giving way soon afterwards when the pressure was increased, bringing through another wave of small trader selling and long liquidation to further reduce the market value to 20.86. The drop was ended by some sharp short covering which quickly returned the price back over 21.00, a modest recovery but one which provided a very small level of psychological benefit. Alongside this latest fall in the underlying there was limited movement for the spreads with the impact being felt uniformly, with March/May’25 sitting in the low/mid 1.40’s and continuing to reflect the Q1 tightness. Moving through towards the close prices were holding a narrow band either side of 21.10, and this situation held into the call. There was some late position squaring seen as the market settled at 21.17 and brought another weak performance to an end, though the close above 21.12 may prove important for the longs attempting to stem the decline.

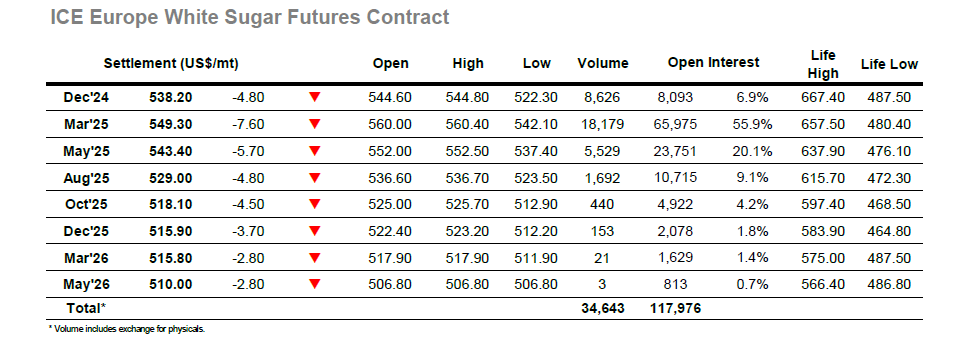

There was a small opening rally for March’25 as the lower levels drew out a little more physical interest and resultant hedge lifting, though this did not stretch beyond the first hour. Progressing through the morning the market started to show fresh signs of vulnerability, and while supportive consumer pricing ahead of the recent lows held for a while the price did break beneath $554.60 to leave values showing at fresh 2-month lows as we approached noon. There was no sign of any buying arriving to save the day and so as the day moved forward so the market continued to track lower, steady in style with no sell stops to be seen, but also constant across the following three hours and sending the price as low as $542.10. The movement did not appear to have any impact upon the funds who remain committed to their now longstanding long positions, however the same could not be said of the white premiums where March/March’25 was eroding back into the lower $80’s. There was a short but sharp lift away from the lows as day traders squared off their shorts, and once this was concluded the market looked to consolidate / limit damage and hold the upper $540’s. Alongside this weakness the Dec’24 contract edges ever closer to an expiry which appears set to see only a small tender with open interest now having reduced to 8,093 lots. On the heels of yesterdays decline the Dec’24/March’25 spread was experiencing another weak showing with the differential moving to an intra-day low at -$19.70 before unbelievably trading sharply up to -$6.50 later in the afternoon. The close was an orderly affair which ended with March’25 settlement at $549.30, concluding another weak performance.