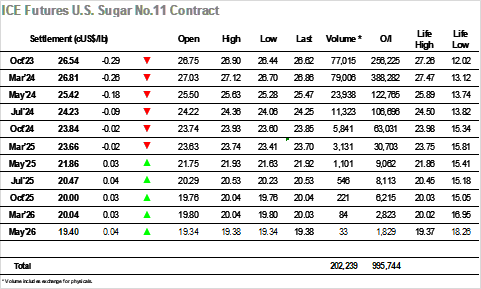

It was a familiar pattern of morning trading for No.11 as initial stability soon gave way to losses, with Oct’23 slipping back to 26.55 before stabilising in the 26.60 area to await the arrival of the US specs. There were small hints that another push higher may be in the offing with the market nudging back up towards 26.80 during the early afternoon, buy the necessary volume was lacking and whether it was pre-UNICA reluctance or just a lack of buying the market continued along within a similar range. Ahead of the UNICA announcement there was a push down to 26.46, possibly on expectations of some neutral/negative data, with the news following to show 2nd half August production at 46.515mmt cane / 3.461mmt sugar / 50.73% mix / 153.93 kg/t ATR. These numbers were largely in line with expectation and that apathy with which the market met the news suggested the specs did not know how to react, leaving Oct’23 to continue trundling along in the range. A move to 26.82 suggested that the specs were making another move toward 27c, however the lack of larger fund support meant that this too failed, with a long liquation correction following to marginal new lows ahead of the close. Oct’23/March’24 saw a lower volume at 43,000 lots as the index roll nears its conclusion, while the flat price ended an inside day with some defensive buying to leave Oct’23 closing at 26.54.

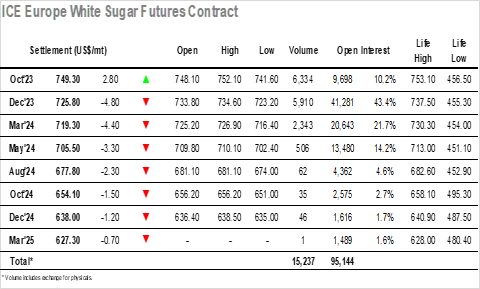

A modicum of buying/hedge lifting showed for the opening however that quickly dissipated and left the market to track lower with very little resting buying found until we moved below $725.00. Here a touch more interest was seen, and proved sufficient to provide a base from which the picture could stabilise, allowing the Dec’23 contract to push back towards $730.00 on spec movements before again stalling. Oct/Dec’23 meanwhile was seeing some strong volume again, only today the buyers were very firmly in the ascendancy as they continuously widened the value, moving from a morning low at $15.50 to trade at $22.00. Despite this spread movement holding up the Oct’23 value the market was stuck steadfastly within the morning range, leading to several hours more being spent between $723.50 / $730.00 on light volumes. There was no change to this scenario, some late buying ensuring a close away from the lows at $725.80 to conclude a calmer session. With 3 days to go until expiry, the Oct’23 open interest had reduced to stand at 9,698 lots. Today has produced another sold Oct’23 volume at 6,334 lots and we will likely see another sizable reduction to this OI figure tomorrow.