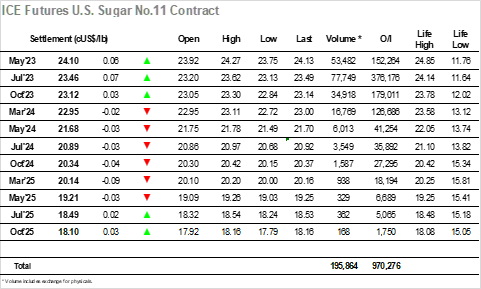

There were small gains recorded initially this morning as the market looked to maintain above 24c and get off to another solid start, however with the buying proving more limited than usual the price soon fell back, falling to 23.75 on light volume as the lack of consumer interest at the higher levels was emphasised. Such has been the size of recent movement that this put us 1.10 points beneath Wednesday’s contract high, yet we were only at levels seen on Tuesday and showing no sign that the weekly lows would come under pressure as buyers soon stepped back in. Their efforts in defending the move had the market trading to new highs by the end of the morning, while a little more spec interest from the US then set the price up to 24.27 before easing back to the range once they had filled their quota. After the huge recent move, it was probably to be welcomed by all sides that this afternoon proved to be a mundane affair, with the price action firmly confined to the morning range and allowing traders to take stock ahead of the weekend. By late afternoon it seemed that the market may end beneath 24c and provide a small psychological blow, however there was some defensive buying limed up from the longs and in the event, they bid the price back up to end the day showing nominal gains at 24.10. Monday sees the May’23 options expire, which ,may confine trading around strike levels according to the option holders wishes to provide more respite from the recent move and allow for a little more unwinding of the technical indicators.

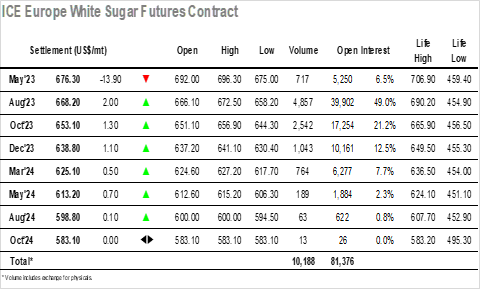

There were some mild early gains for Aug’23 as we opened however these quickly gave way to weakness with the market retreating further from the recent contract highs as it slid to $658.20. Of course, after such gains and with many spec and trade longs sitting well in the money there is a desire and capability to pick things up to defend against a more significant decline and this happened again today with prices pulled all the way back up to be trading around the highs again by noon. There was a small continuation of the move to $672.50 as the US morning kicked off, however that proved to be the end of the movement with buyers then withdrawing to leave prices back within the range. Eyes were on the May’23 contract ahead of the expiry this evening with the May/Aug’23 falling back from its highs over the course of the session, a range of $25 to $10 seen against a modest volume of 538 lots. Aug/Oct’23 while more active was calm through the flat price movements and sat comfortably either side of $15 through the day. The afternoon proved to be very quiet as prices maintained within the range throughout, a quiet end to another wild week as Aug’23 settled a couple of dollars firmer at $668.20. May’23 settled at $683.00, expiring at a $14.80 premium to Aug’23. Early news suggests that 4,851 lots (242,550mt) is being tendered, with a mix of Thai, Brazilian and Indian origin anticipated. Full details will be published by the exchange on Monday.