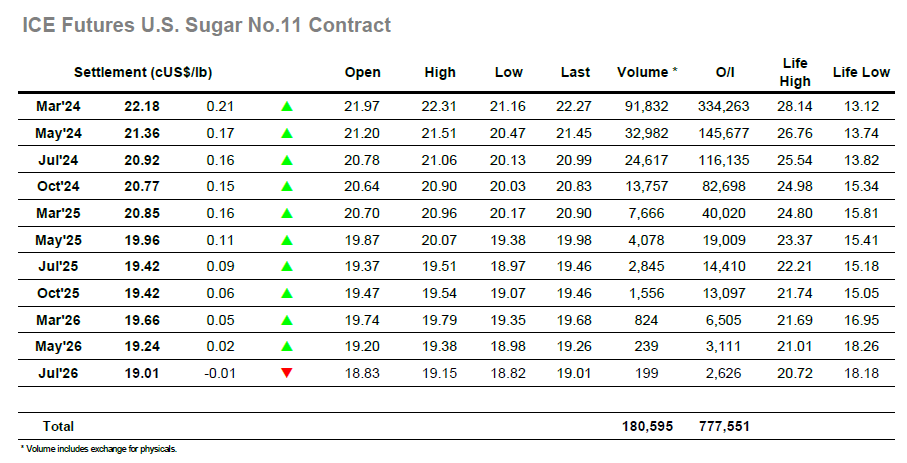

A stable opening soon gave way to another round of losses with morning selling sending March’24 careering through Tuesdays lows to another new mark for the move at 21.27. The 60-point decline occurred on just 6,000 lots of selling, such is the lack of resting support, but despite this vulnerability the market was able to stabilise through the rest of the morning with the price action taking place in the 21.50’s/21.60’s. This recovery provided some optimism heading into the afternoon, but the arrival of US specs soon quashed this with another downside push taking place and extending the low to 21.16 despite fresh scale buying ensuring a more orderly path. With prices on the lows the spreads were again being impacted with March/May’24 into 0.69 points and May/Jul’24 to 0.34 points, however both they and the flat price were to find some respite over the rest of the afternoon. Initial consolidation developed into a more substantial recovery which saw March’24 extend to 22.31 during the final hour, and while this move was again based on only modest volumes it provides hope to any remining longs that the recent pain may be nearing an end. Heading into the call we moved back towards the highs, leading March’24 to a positive close at 22.18, still with more work to do if a bottoming pattern is to form but showing signs that the pain may be easing for now.

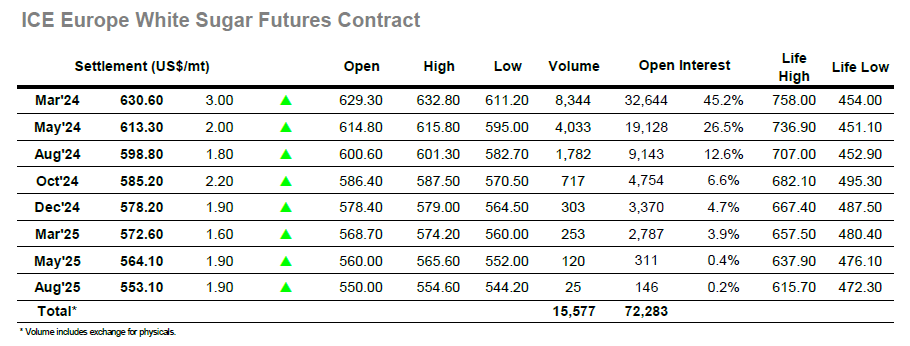

A marginally higher opening was in keeping with expectations of ongoing physical activity / hedge lifting however the higher levels were not maintained for long with sellers soon in the ascendancy once more. The lack of buying was then illustrated with a sharp decline to $612.80, more than $15 being wiped off the market in little over 20 minutes before finding sup[port against opportunistic pricing/short covering. The decline pushed March/March’24 down to $139.00 but both the premium and flat price then stabilised with the rest of the morning playing out either side of $620.00 and giving traders the chance to breathe. With new lows for the move already seen the afternoon saw a fresh wave of interest from shorter term specs who showed a determination to continue testing the lower end, with their efforts yielding further new lows at $611.20 though not attracting the same scale of decline as seen this morning. The market remained reluctant to rally very far with a period spent just ahead of the lows, though by late afternoon there was more of a recovery with short coveri9ng driving the price higher to erase the losses. This momentum continued through into the close and ensured a positive close at $630.60, while new daily highs at $632.80 added minor gloss for those clutching for any positive straws.