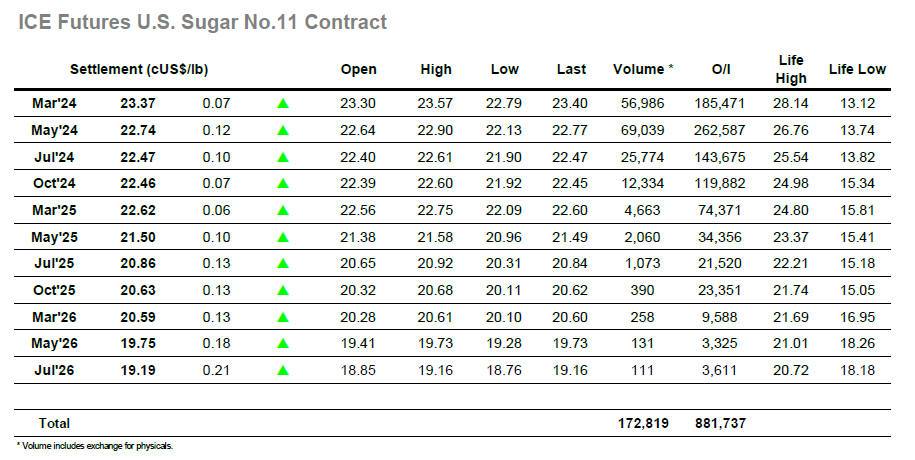

A first print at unchanged quickly gave way as selling swamped the market following yesterday’s poor performance and it was only minutes until May’24 was trading down beneath last week’s 22.44 low mark to be at the lowest levels since the mid-January rally. The market paused but the was by no means the end of the decline with specs now determined to use the weak technical picture to their advantage and pressure from the short side, reaching a morning low at 22.16 following a couple more waves of selling effort. Prices continued at the lower end of the range through into the early afternoon but despite a marginal new low at 22.13 there was not the selling that the shorts would have hoped for coming from the US and so a short covering rally developed. This changed the whole complexion of the day with the market now soaring upward through a liquidity vacuum, culminating in highs some 0.77 points above low at 22.90. Inevitably the rally could not continue indefinitely and with some day traders having turned long there was a correction back to unchanged levels as positions were squared off. Through the wild movements there was some moderate spread volume with the trading ranges quite narrow in the circumstances, March/May’24 sitting between 0.60 points and 0.69 points and incurring mild daily losses as sellers drove the spread narrative. The later stages saw the price remain steady within a band to the top of the range, ensuring a close for May’24 at 22.74 which maintains the rangebound status quo for the market for a little longer.

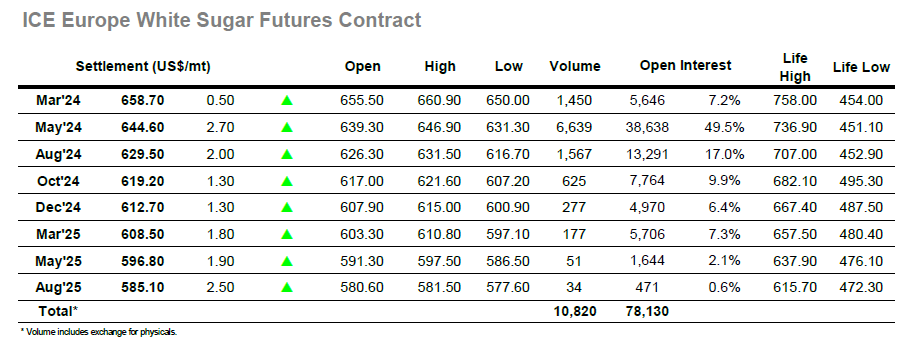

Since recording a high at $662.80 during last Friday’s session the market has been weakening and that trend was maintained this morning with initial selling leaving a gap on the intra-day chart and sending the price down towards the recent $632.50 low mark. By mid-morning, this level had been surpassed with lows at $631.30, but though this represented a four-week low there was sufficient buying interest from consumers to negate any technical input and provide stability for the next few hours. As ever with most of the activity coming from the specs it was only be a matter of time before a position covering move took place and when it arrived the reaction was rapid. With so little resting selling in place the market quickly rose to fill the intra-day chart gap with a further acceleration then taking the price up into credit at $645.00. This prompted some profit taking by longs however this weeks trend appeared to be well and truly reversed with buying resuming later in the afternoon to push values back upward to new session highs. There was some late position squaring which pulled May’24 back a little to settle at $644.60, however the overall nature of the day was one of stability with the latest effort to force prices lower having been rejected. Tonight’s March’24 expiry is expected to see 5,239 lots (261,950mt) tendered. Full details will be issued by the exchange tomorrow morning.