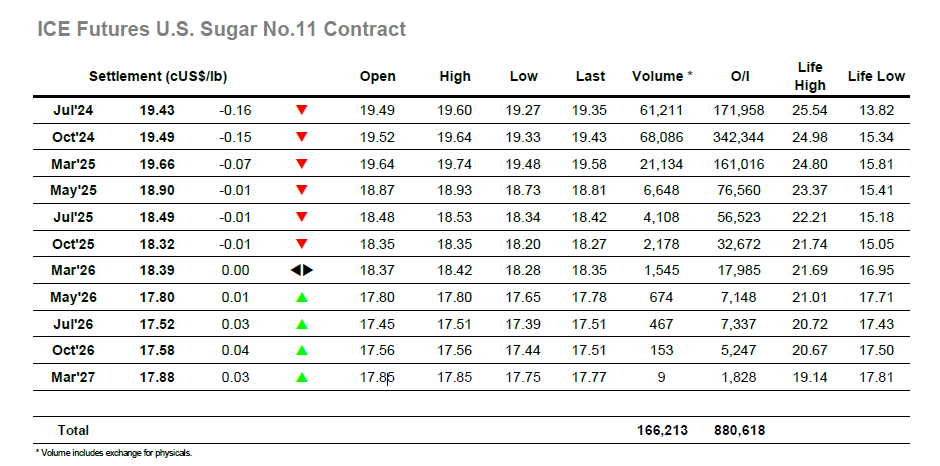

This market continues to confound when presenting technical signals, with the immediate response to yesterday’s positive movement being an opening drop to 19.37. This was gathered up and the market returned to overnight values, however there was not the depth of buying seen yesterday and from a high market of 19.60 the picture settled down and prices sat within the range. This pattern maintained into early afternoon at which stage the market moved down to new lows as the lack of buying led to some fresh small trader selling. Upward movement appeared in line with the UNICA publication of numbers for SH May though with the data showing Cane 46.771mmt / Sugar 2.926 mmt / Mix 48.65% / ATR 134.95 kg/t / Ethanol 2.122 mlt, marginally higher than most estimates, there was soon a reaction lower and brief trades at a new 19.27 daily low. Short covering pulled the market back into the range and through the final couple of hours the air of calm returned with Jul’24 sitting comfortably either side of 19.50. This pattern continued into the close when some pre-weekend selling/liquidation dropped Jul’24 to a 19.43 settlement, with more following on the post close to bring a neutral day to a conclusion.

Unchanged opening values were not sustained, and the market soon started to fall away into the lower $560’s. As is normal the higher levels mean a reduction in consumer activity / pricing and so while the market moved back up from the early lows to sit quietly sideways it was small traders dominating the activity. There was only minor change as we moved through into the afternoon with the pattern remaining broadly sideways, though marginal new lows were seen, reflecting the better interest from the grower side. While this movement wasn’t overly significant, there were some swings being seen for the Aug/Jul’24 white premium as No.11 flitted around, with Aug/Jul’24 finding its way above $137.00 midway through the afternoon but subsequently dropping back by a few dollars. Spreads meanwhile were showing some signs of rolling with just a month now remaining until the Aug’24 expires and having sat quietly during the morning Aug/Oct’24 fell back sharply during the final couple of hours to trade down to $15.40. This weakness coincided with a late selloff that dropped Aug’24 back to $560.00, ending the week on a poor note considering all that had gone before. Settlement was made at $562.10, while Aug/Oct’24 closed at $15.90 with the Aug/Jul’24 white premium valued at $133.75.