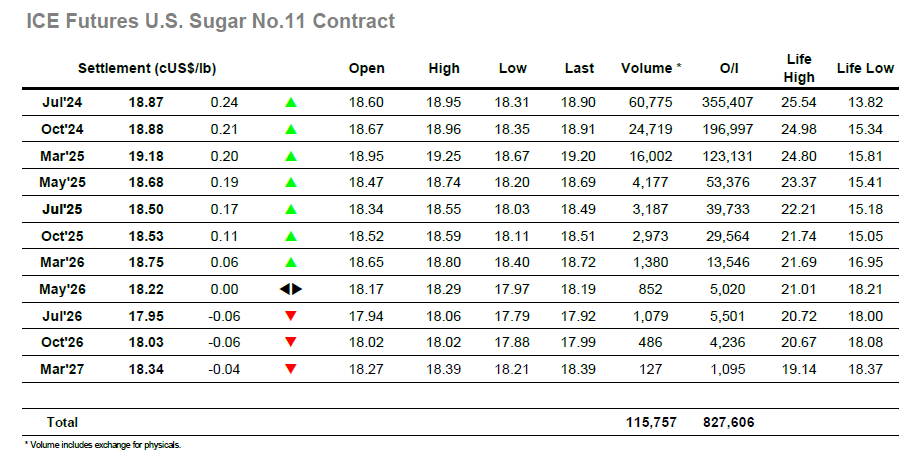

An unchanged opening quickly gave way to additional losses, with the market failing to uncover any meaningful physical activity despite having fallen to the lowest levels in more than a year. The pace of decline was not wild, though it was not until Jul’24 had slipped towards 18.40 that the market found some respite against continuing consumer pricing. This led the market back to consolidation mode for the rest of the morning though the negative picture meant that specs were sitting contentedly on their shorts and showing no sign of taking cover. The period ahead of the US morning saw another push lower which extended the losses to 18.31, though rather than inspire a continuation of the move from US specs we instead found no new selling and sparked a short covering rally. With the market tracking back up through a vacuum we moved on lighter volumes than seen on the way down, only slowing once the necessary cover had been taken by day traders having reached the 18.70’s. Mid-afternoon consolidation was followed by another covering push which reached 18.95, before playing out the later stages within proximity of this mark. Settlement was reached for Jul/Oct’24 at 18.87 which represented a solid recovery from the lows, but whether it will prove to be a ‘dead cat’ remains to be seen with more work still required to bring any gloss back to the charts.

The market managed to muster up an unchanged opening despite already lower No.11 values, though within minutes we saw Aug’24 beginning to follow lower once again. With the market at yearly lows there is no support to hang on, and so the onus lay with scale buy orders from consumers / end users to provide reason for the market to hold. Reaching to the $545.00 area this happened and the next few hours were spent tracking quietly sideways, leading volume to fall away as traders awaited some fresh impetus. More selling appeared during the early afternoon, likely looking to trigger selling from the larger US specs, however there was no reaction from the other side of the Atlantic and the weaker shorts reacted by covering back some positions and returning Aug’24 back above $550.00 and into small net credit. Throughout this flat price movement there was another weakening of the nearby premiums to levels seen a few weeks ago, Aug/Jul’24 levelling out in the $138.00 area with prints nearer to $137.00 along the way. By contrast the Aug’24 spreads were again proving resilient and Aug/Oct’24 only narrowed a little to $21.80 intra-day before moving back higher to $24.90. The flat price maintained the bounce with the final couple of hours spent in credit, recording a high at $555.90 before settling at $553.00. Overall, this could have been worse, though having pretty much matched the former low $555.80 on the bounce there remains work to do to remove the current negative chart appearance.