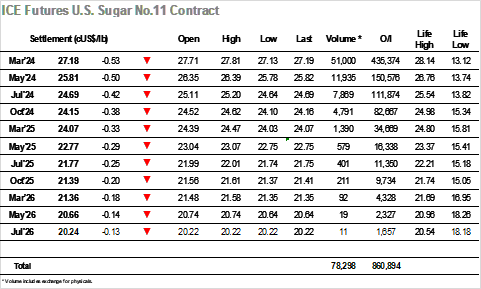

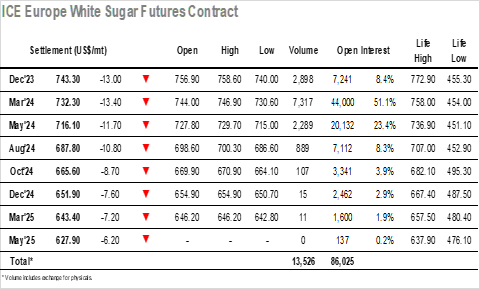

Despite the strong conclusion to yesterday’s session there was a subdued air about proceedings initially as March’24 tracked along near to overnight value. Last nights delayed COT report showed that that had been a larger than anticipated increase in the net speculative long holding to 188,702 lots (+28,286), and while the daily swings since have likely only led to minor change to this number the evidence of yesterdays defensive buying suggests a keenness remains amongst the shorter-term entities to try higher again. Mid-morning saw small signs of this desire as day traders pushed the price to 27.81, though the move lacked substance and by noon we had retreated to the upper 27.60’s on long liquidation. The arrival of US based traders then saw the market revert to type with a slide back through the current range to 27.37, and in keeping with recent days the movement was typified by low volume. Consumer buying to the lower end then provided an element of support and enabled a small bounce to take place, though increasingly the market gravitated back towards the lows before extending the daily range down to 27.31. This was not the end of things and the selling continued through into the final hour, resulting in lows at 27.13 for March’24 and settlement at 27.18, back to the bottom of the near-term trading band and a cause of concern for the recently added longs.  It was a quiet start to today’s session as March’24 ticked either side of unchanged, and while the price ticked up to $746.90 midway through the morning there was little spec interest to continue the move and so prices soon eased back to show negatively. By late morning we encountered some light long liquidation/profit taking versus yesterdays buying which sent the price back towards $742.00, in the process knocking the March/March’24 white premium down towards $133.00. This retreat grew larger as we moved into the afternoon with March’24 dropping to the upper $730’s to maintain the range of the past week, in the process encouraging more of the short-term traders to close out of long positions. With the flat price activity now being driven by March’24 the retreat was in no way hampering the front month spread which widened to $13.80 against the last of the pre-expiry rolling before easing back from this mark later in the session. Outright values continued to fall as the afternoon drew to a close, wiping out all of yesterdays gains and more as the price fell to $730.60, the lowest level recorded since 1st November. There was some defensive buying for the close which led to settlement at $732.30 while the late weakness ensured a softer close for the white premium at $133.00. The Dec’23 open interest reduced by 1,999 lots yesterday to now stand at 7,241 lots. Dec’23/March’24 ended the day at $11.00.

It was a quiet start to today’s session as March’24 ticked either side of unchanged, and while the price ticked up to $746.90 midway through the morning there was little spec interest to continue the move and so prices soon eased back to show negatively. By late morning we encountered some light long liquidation/profit taking versus yesterdays buying which sent the price back towards $742.00, in the process knocking the March/March’24 white premium down towards $133.00. This retreat grew larger as we moved into the afternoon with March’24 dropping to the upper $730’s to maintain the range of the past week, in the process encouraging more of the short-term traders to close out of long positions. With the flat price activity now being driven by March’24 the retreat was in no way hampering the front month spread which widened to $13.80 against the last of the pre-expiry rolling before easing back from this mark later in the session. Outright values continued to fall as the afternoon drew to a close, wiping out all of yesterdays gains and more as the price fell to $730.60, the lowest level recorded since 1st November. There was some defensive buying for the close which led to settlement at $732.30 while the late weakness ensured a softer close for the white premium at $133.00. The Dec’23 open interest reduced by 1,999 lots yesterday to now stand at 7,241 lots. Dec’23/March’24 ended the day at $11.00.

Back to CZ Insights

Daily Market Price Updates and Commentary 14th November 2023

Become a Thought Leader on our App

Are you an industry expert in:

• Soybeans

• Grains

• Dairy

• Fruit

• Freight

• Orange Juice

• Nuts and Seeds

• Fertilisers

• Carbon

We’re looking for leading voices who want to contribute their expertise to a global audience.

Find out how a partnership with us works below.