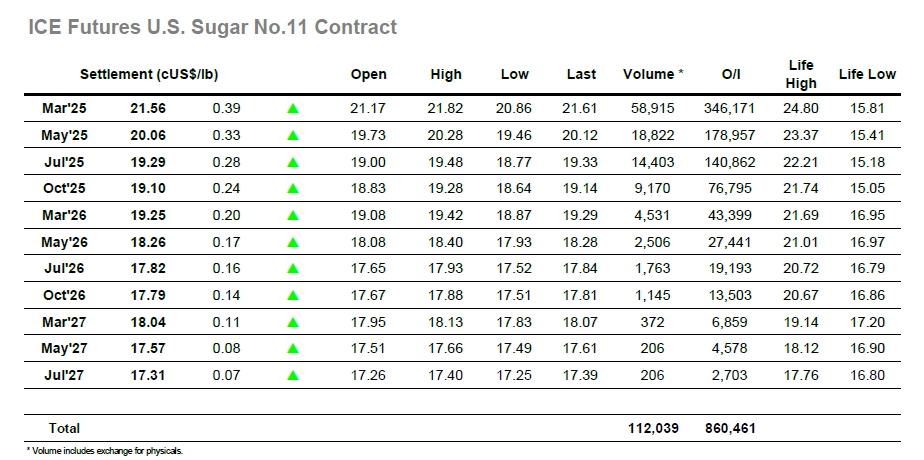

Marginally higher opening prints were not sustained and on low volume the market soon started to work lower again. It took a couple of hours for the 21c level to be investigated, but with only light scale buying in place until the 20.80’s it had no psychological benefit, and the price action moved to a 20 handle during the later morning. Reaching noon, the market matched yesterdays low mark at 20.86, and having done so without attracting the necessary selling to push into the larger scale buy orders there was a small recovery against some day trader covering. As the wider spec community in the US joined proceedings the market found sudden and somewhat expected support with a modest amount of buying forcing remaining short holders to cover and quickly sending prices up into the 21.30’s. This caused a tactical rethink amongst the specs who dominate most sessions and generated additional buying through the afternoon to further extend the recovery, only topping out having traded some 0.96 points above the morning lows at 21.82. Such gains are tough to maintain, however a reasonable proportion remained through to the end of the day despite the inevitable long liquidation / position squaring from the day traders. March’25 made settlement at 21.56 with March/May’25 firmer at 1.50 points with the market appearing steadier once again having reversed a large proportion of this week’s losses.

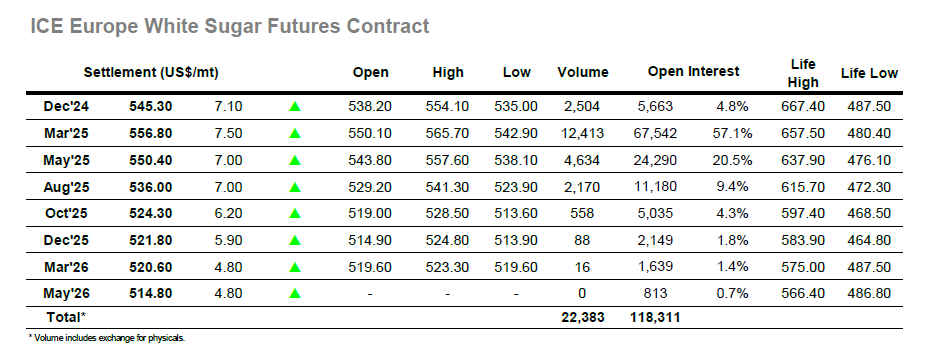

The market continues to face technical pressure, and this quickly impacted on values with March’25 dropping back through the $540’s across the morning to a low at $542.90. This placed the market just 0.80c above yesterday’s mark, but with consumer buying dotted about there was sufficient support to edge back up slightly before the Americas based traders entered for the day. Their arrival provided the most positive action we have seen this week with prices working back into credit at a decent pace, and while it was not a spectacular move it did start to encourage some buyers to pay up for fear that they had missed the lows. Through the middle of the afternoon March’25 consolidated in the $555 area, and from here there was a second, sharper rally which accelerated the market through a vacuum to reach $565.70. While impressive in its own way this only brought values back to the levels we were seeing on Monday, though the scale of the recovery does leave the lows a distance away and potentially returns the market to rangebound conditions once more. Dec’24 meanwhile saw another drop in the open interest to stand at 5,663 lots, and aside from some final AA postings and fine tuning of positions seems set for a smooth run into expiry tomorrow evening. Following a period consolidating near to the highs the last hour saw prices drop against position squaring, though healthy net gains remained in place overall. March’25 settled at $556.80 with Dec’24/March’25 at -$11.50 heading into its final day.