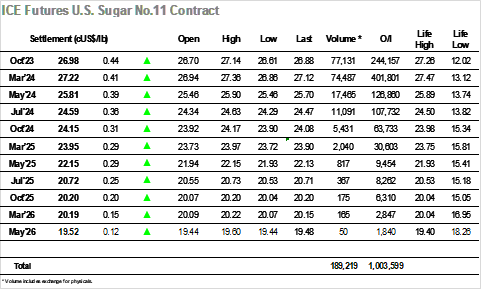

No.11 began the day positively with an initial push up to 27c, the specs clearly still maintaining the positive sentiment and feeling that there is more potential upside movement and opportunity. This issue remains that not all participants are so willing to pay the current high prices and so there was a familiar feel about the market as prices corrected back towards 26.80 before midday. The arrival of the US specs duly brought some fresh upside impetus with new daily highs posted, however the nature of the specs meant that profit taking again followed to leave values see-sawing either side of 27c. The Oct’23/March’24 spread was meanwhile reaching the end of the index roll and held the above -0.25 points for most of the session. There was no real change to the pattern through then rest of the afternoon with smaller specs and algos still dominating, and while this provided a degree of movement it was of little significance. New highs were recorded during the final hour at 27.14 before falling back to leave settlement at 26.99, well poised to try and end the week on a firm note.

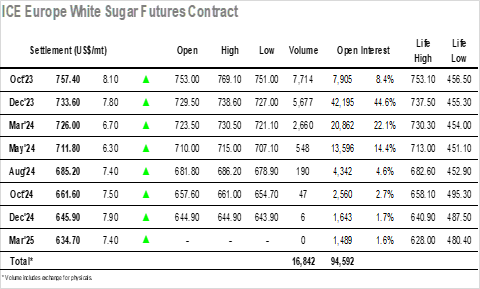

The day started positively with early buying taking Dec’23 higher, and aside from a brief dip to $727.00 the market remained firm throughout the morning, climbing up to the mid $730’s to sit within striking distance of the $737.50 contract high. Volumes were light and the scene was being dominated by the expiring Oct’23 position where buying both outright and into the spread served to send the price more than $10 by mid-morning while widening Dec/Oct’23 towards $30. The pattern of trading was set and the trend continued through the next few hours with Oct’23 pulling higher still and recording a mark at $769.10 (+$19.80) as the spread reached $32.00. Dec’23 meanwhile ‘only’ saw a gain of $12.80 as it made a new contract high at $738.60, before the lack of follow-on interest led some longs to take profits. The rest of the session proved calm for Dec’23 with the price action holding a band in the lower $730’s, though for Oct/Dec’23 it was different as the pre-expiry rolling led the spread to $32.00 before falling back sharply and printing at $19.80 late on. The spread ended the day at $23.80 while Dec’23 closed at $733.60, a solid showing once again to please the bulls. Oct’23 Open interest has fallen again to 7,905 lots, suggesting we will see a moderate sized delivery once any remaining rolling and AA postings have been concluded. Today’s Oct’23 volume was 7,714 lots and included a sizable 2,300 lot AA, suggesting that the delivery will be relatively modest with sugar being taken away from the tape.