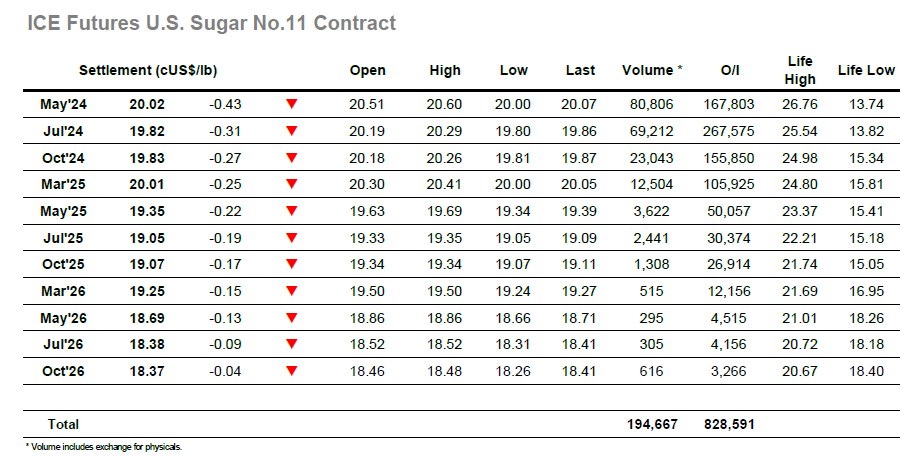

Last weeks collapse has left the market probing at support levels not seen since late December and the new week started with a continuation of the pressure which sent Jul’24 down to 19.94. Sub 20.00 the market was finding scale buying interest and a bounce soon followed on short covering to take the price back to the upper teens where a period of consolidation ensued. There Was no change to the price moving through to the early afternoon and the Americas day, and the picture changed little for a couple of hours more with a small extension to record highs at 20.29 being the only activity of note. It was only during the final part of the day that some activity of note occurred, and it was once more being dictated from the short side. Day trader liquidation sent the price back down through the range and beneath 20.00, and this in turn drew some more aggressive liquidation from specs, further impacting the COT which had already reduced to 33,038 lots net long as at last Tuesday and now likely stands nearer to flat. Pressure was maintained right the way through to the close with Jul’24 reaching lows at 19.80 and settling only just above at 19.82. May’24 meanwhile took another hit to end the day at 20.02 after the May/Jul’24 had traded into a narrowest 0.18 points. Overall, this adds to the current vulnerability with the December low at 19.68 now providing important support.

The market has found buying hard to come by recently and that trend continued during the first part of the session with a fall to $581.00 before finding a degree of support. This allowed for some day trader covering before values stabilised in the $585.00 area, then moving sideways through the rest of the morning to provide some welcome relief in the recent trend for any remaining longs. The period of consolidation extended well into the afternoon as flat price activity remained calm, though at the top of the board there were some far wilder moves being seen as May’24 manoeuvred through its final session. May/Aug’24 on very limited volume managed to range an incredible $25 to $50 band, with the white premium even wilder as the illiquidity shone through. Aug’24 meanwhile saw fresh movement through the final couple of hours and again it was pressure being applied from the short side which drive values lower. Fresh ground was broken though scale buying limited the losses and maintained a degree of order, with lows registered at $580.00 on the call. Aug’24 settlement was right above this low at $580.20 and brings the next technical target level of $573.70 (March 5th low) into view.

May’24 expired at $615.20 with the May/Aug’24 spread valued at $35.00. Early news is suggesting a tender of 6,279 lots (313,950mt) with full details to be published by the exchange tomorrow.