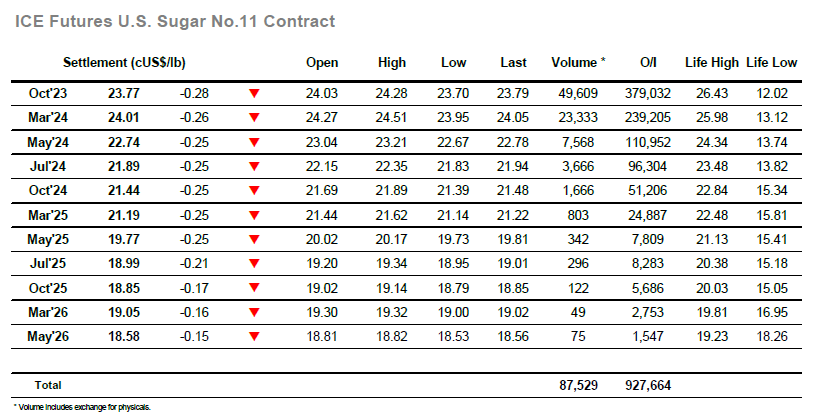

Last night’s recovery to end back above 24c inspired some buying into the market as we resumed, leading Oct’23 back up through the same familiar range during early trading, Support maintained through most of the morning with the price topping at 24.28, shy of yesterday’s highs and prompting some long liquidation from day traders that sent the price all the way back to 24.03 ahead of the US morning, A familiar pattern then emerged with the market once again consolidation ahead of 24c, the moderate consumer buying interest found in this area proving sufficient to generate some calm. It was mid-afternoon before any additional movement was generated and this time the day trades/specs looked to heap some pressure on the downside, determined to generate some profitable momentum and end the rangebound uncertainty. The lower path proved easier to maintain and we removed the reminder of Fridays gains on route to final hour lows at 23.70, ending only a small way above at 23.77, potentially bringing last weeks low at 23.40 back into view.

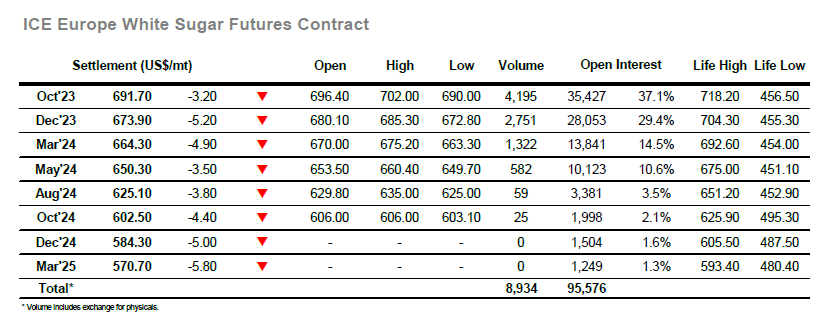

The whites have proved resilient in comparison to No.11 over recent sessions and that pattern maintained during morning trading as prices were again pushed to take Oct’23 back through $700. Highs were recorded for Oct’23 at $702.00 and while the market subsequently set back by a few dollars to sit in the upper $690’s the positive leaning was evident through further white premium gains, Oct/Oct’23 moving to the $169.00 area and the 2024 positions making some net gains also. This was all well and good, however the wider macro was not performing nearly so well, and with No.11 also poorly performing the market eventually had to follow lower, leading to an afternoon spent dropping through the $690’s. Still, this did not significantly impact the white premiums which remained firmer, while the Oct/Dec’23 spread also had another stellar showing in the face of a falling market in widening to $18.40. Oct’23 recorded a session low $690.50 during the final hour before ending the day a small way above this mark at $691.70, still firmly within the range.