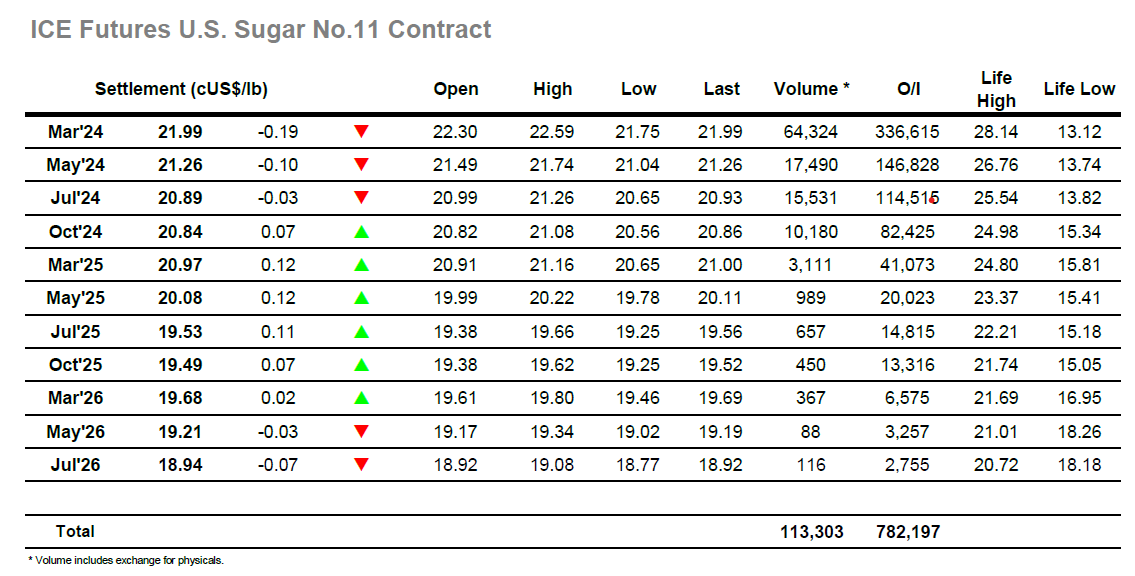

It was the quietest start to a session for a while as March’24 tracked either side of unchanged levels through the first couple of hours, and while the range then widened with a small push to 22.42 there was no traction, and the gains were soon erased. With volumes on the low side and activity being dominated by small specs / day traders the market then turned lower with a push down through 22.00, however this move also met with no success and ended with a sharp short covering rally. For the flat price, the games continued with another failed effort higher which topped out at 22.59 before widening the range at the bottom end also with long liquidation into a relative vacuum seeing the price plunge to 21.75. Throughout this activity the one consistent factor was the March/May’24 spread which was struggling regardless of the flat price direction and narrowed to a lowest 0.72 points, a lack of buying apparent despite the markets efforts to try and establish some kind of bottom. The final part of the session played out calmly around the bottom of the range, with March’24 closing out the week at 21.99 following late position squaring, and as eyes turn to the COT to discover just how large the fund selling has been to last Tuesday we may find whether sufficient has been done to allow for slightly calmer trading ahead of the holiday season.

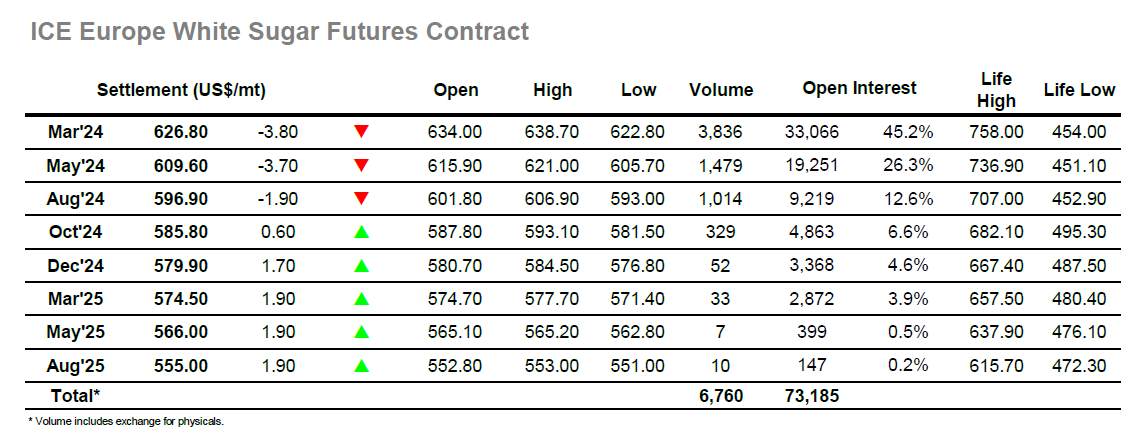

There was a sense of fatigue about the market today with recent exertions having taken their toll, the morning activity either side of $630.00 on low volume suggesting that most traders are still licking their wounds. For several hours there was a sense that even the usual collective of day traders was barely interested in proceedings, but the afternoon saw some additional interest develop. There was little substance to the movements which were aided by a lack of resting orders to both directions and this allowed March’24 to push first to $638.70 before tumbling back to $622.80, what would ordinarily be significant movement but after recent events almost passed without notice save for those trying to make a turn. There understandably remains some nervousness from buyers, evidenced by the way that the later stages played out to the bottom of the range, though some late short covering served to bring March’24 back up to $626.80 and end another tumultuous week in neutral fashion.