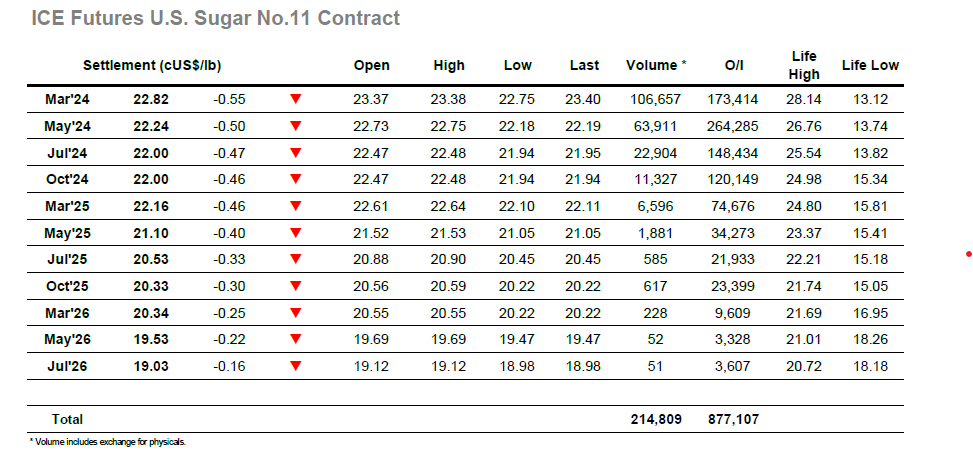

An unchanged opening proved difficult to sustain and it was not long before the market was tracking back lower through yesterday’s range on the usual array of spec and algo interest. Initial May’24 lows were registered at 22.47 but despite a small covering move the trend was set once again and sufficient selling interest appeared to ensure a series of marginal new lows throughout the rest of the morning. Tonight sees the March’24 options expire and so there was a feeling that the front month would be looking to find a suitable strike level to hold near when the close came around. For much of the afternoon that level looked to be 23.00 with March’24 flitting either side of that level while May’24 drove the market in the 22.40 area against continuing spec activity. There was a move down to 23.22 for May’24 later in the afternoon as some additional pressure was applied at the front of the board, potentially bringing the March’24 22.75 strikes in to play, and this remained a feature as the close approached with another push lower seeing March’24 to 22.80 and May’24 to 22.20. There was a final effort made on and around the call with March’24 eventually reaching 22.75, though its closing value at 22.82 meant that exercise choices were straightforward. May’24 meanwhile settled at 22.24 to conclude an eventful inside day, though with the recent lows now back in view might we see a lower move to take us to the weekend.

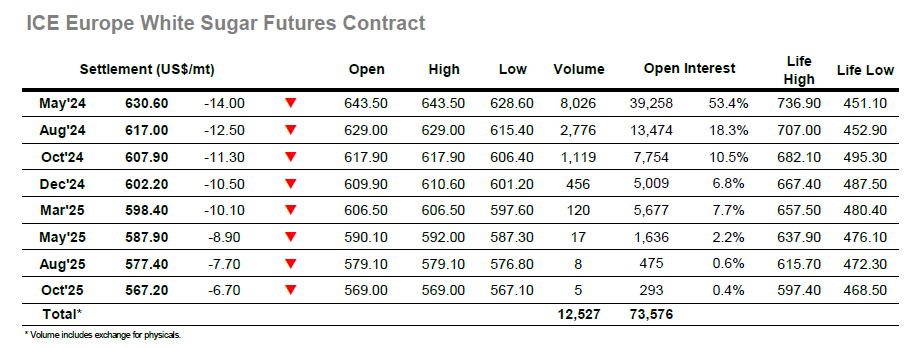

May’23 began its tenure at the top of the board negatively with the early stages seeing a quick punch back beneath $640.00 and extending all the way to $633.80 with less than 30 minutes of trading elapsed. Activity then calmed somewhat with underlying consumer interest providing an element of support, though short covering was only muted with the small bounce soon ending. Instead, the market resumed a downward path with prices edging slowly into the underlying buying to be making new lows by late morning that were within 0.10c of yesterday’s mark. Sentiment from day traders naturally remained negative and so the afternoon saw a continuation of this trend, and though punctuated by occasional covering moves the May’24 contract worked to a series of marginal new lows which culminated with a peek beneath $630.00. This weakness was impacting the white premium values quite significantly, and whether it was because of the make-up of March’24 tenders or simply a sentiment driven move the May/May’24 value was several dollars shy of yesterdays levels as it worked down towards $137.00. The market remained under pressure through the late afternoon with session lows made at $628.60. Settlememt was recorded at $630.60, and with yesterday’s recovery forgotten the chart suddenly appears a little vulnerable once again. As expected, the March’24 expiry saw 5,239 lots (261,950mt) tendered.