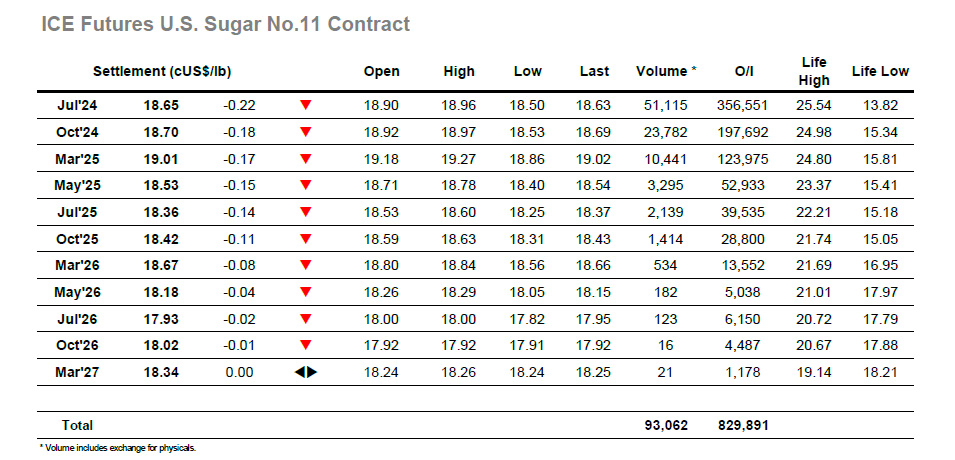

It was a mixed opening period with the market uncertain following yesterday’s movements, with Jul’24 dropping back from initial higher prints and then clambering back to unchanged. Much of the morning continued in the 18.80’s though as noon approached so the price started to erode again with buying proving sparse. This trend continued through the early afternoon with selling mostly coming from day traders / algo systems, and with the latest set of UNICA numbers due this afternoon it was likely in anticipation that the dry weather would produce some solid production numbers. Before the numbers arrived, there was a short covering rally however the market had returned to 18.70 at publication. The news for SH April showed Cane 34.575mmt / Sugar 1.843 mmt / Mix 48.37% / ATR 115.63 kg/t / Ethanol 1.515 mlt, marginally higher than expected though clearly not as high as some had hoped as it prompted another covering spike to 18.89. This proved to be a blip and the market soon returned to consolidate the 18.60’s, quietly seeing through the rest of the afternoon in this area on diminishing interest. Jul/Oct’24 saw moderate activity as it continued at a small discount, but there was little other activity across the rest of the board. Reaching the close the market continued in the same pattern, ending the day at 18.65 though with the pressure still firmly upon the market.

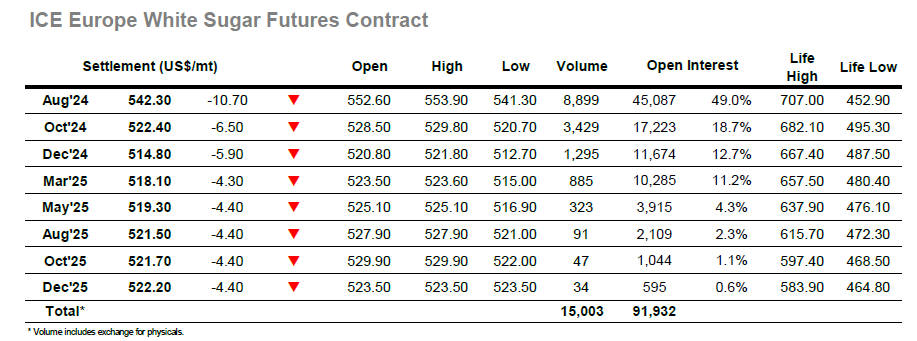

It was a mixed morning for the whites following on from a performance which provided little clarity as to short-term intentions, and so the Aug’24 range between $553.90 / $550.30 encapsulated this perfectly. By later morning there was some additional interest in generating movement from smaller traders and given the recent woes it was the lower side that again drew their focus with a push back down though $550 for Aug’24. It was only from the mid $540’s that any consumer interest started to be uncovered again as they started scales ahead of yesterdays lows, and this provided support as we moved through the afternoon, allowing the flat price to chop around the mid/upper $540’s but generally just on speculative noise. In contrast to the air of weakness overhanging the market there remained some contrarian resilience about the spreads with Aug/Oct’24 remaining above $20.00 (lows at $21.20) though the same could not be said for the white premium. Here the recent efforts to push into the $140’s were long forgotten with Aug/Jul’24 weaking throughout the session, and by late afternoon it was at its lowest levels for several weeks and trading $131.00. The Aug’24 weakness was such that new yearly lows were recorded ahead of the close at $541.30, ahead of some late position squaring which left settlement a dollar above at $542.30.