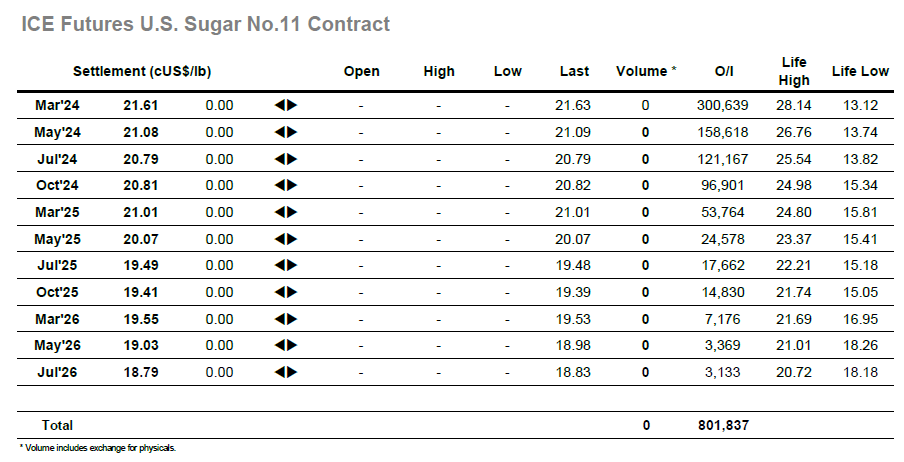

Sugar No.11 market is closed today due to Martin Luther King Day holiday

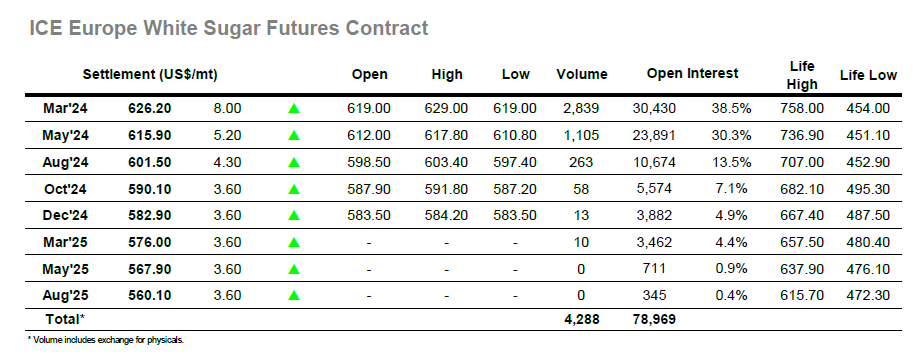

The day started positively as hedge lifting took March’24 higher, and with selling still thin on the ground the market rose to hold gains of a few dollars by mid-morning. Support for the spot month was also being found through the spreads with March/May’24 pushing back up towards $10, though volumes for both the spread and outright were not overly significant. By noon, the market had found another burst of buying which accelerated the price to $626.90, and with the US closed there was not proving to be a ceiling to the market with the heavier producer scale and white premium link not in play. Prices consolidated comfortably through the afternoon before another push saw session highs at $629.00, a remarkable $10.80 higher which would potentially leave No.11 due an unlikely 50 points firmer tomorrow morning. Unsurprisingly there was some selling pre-close as some profit was locked away by longs, though settlement at $626.20 still provides a strong call around recent highs for March’24 No.11 tomorrow should traders wish to follow the indication.