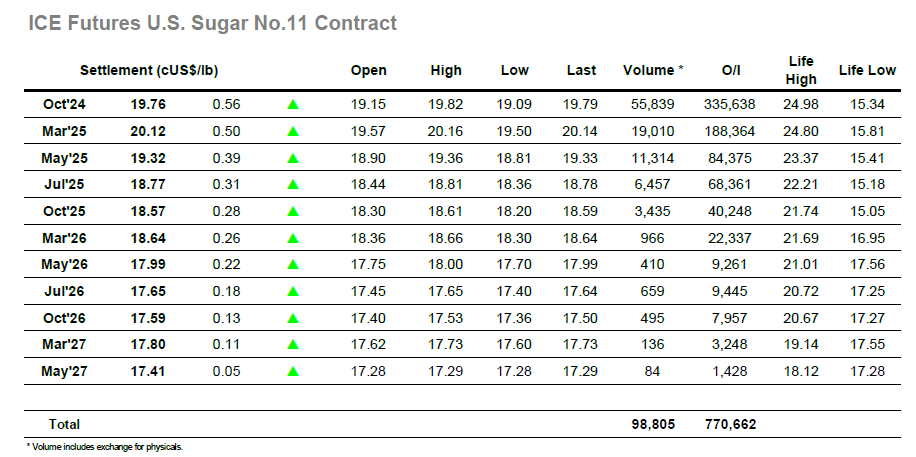

The market set back a small way on the opening and set the tone for a quiet start to the week with Oct’24 edging along in a tight range and consumer support from 19.11 down holding values. There was a small pick up to the mid 19.20’s but that failed to garner much additional support and by early afternoon the price had dropped to a new session low of 19.09. Fridays COT report had shown the specs remaining long, with a mild reduction in holding leaving the position at +6,539 lots, and while the movement since Wednesday would suggest more selling has taken place the data shows that specs currently are not looking to return to the short side. This was illustrated through the afternoon as the market turned back upward, regaining recently lost ground at a quick pace on light spec buying while sellers remained away from the market. The move extended to 19.80 before a pause arrived on some day traders profit taking, though the market didn’t fall back very far leaving it well positioned ahead of the close. Oct’24 ended at 19.76 to bring some positive impetus back, though a resumption of the upside will require a lot more work.

The week got underway quietly with Oct’24 quickly settling down to hold a narrow band near to unchanged, digging in to try and stem the recent decline. There remains decent underlying consumer buying while the latest COT data showed growth to the already significant spec long holding, suggesting the recent fall hasn’t dampened the overall view of the market. Early afternoon did see a nudge lower to $539.00 for Oct’24 however it failed to gain much momentum and the price soon started to turn away from the lows. With little selling in place at these lower levels the market suddenly gained some momentum and as the rally gained pace so Oct’24 pushed above $560 to be more than $20 above the lows. It was not just Oct’24 gaining momentum with Aug’24 also showing fresh strength to widen the Aug/Oct’24 spread back out, reaching $15.00 on an afternoon spike with volumes having reduced considerably ahead of tomorrows expiry. Aug’24 open interest now stands at just 4,456 lots, and with todays activity considered it seems the tender will be fairly small. The market remained buoyant through the later part of the afternoon leading to a positive conclusion as Oct’24 settled just $1.50 shy of its highs at $560.50.