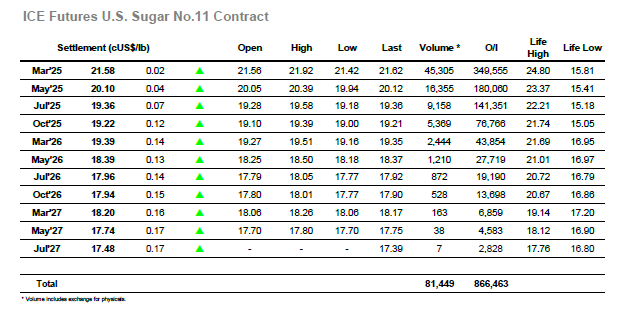

Commencing the day at unchanged the market enjoyed a calm start with sideways trading prevailing through the early stages. A little selling then emerged which caused prices to drift down a small way, however it was based on token volume and as noon arrived the price had only slipped to 21.42. The US morning then brought some additional colour to proceedings with prices pulling back to unchanged before a second push took the price through to 21.70 as enthusiasm grew amongst the days traders and smaller specs. Their efforts led prices to spike upward once more time to 21.92, just 0.04 points shy of Mondays high, however with no continuation the move proved to be a spike and position squaring followed. The immediate failure killed the momentum, and most traders then stood aside to leave the market edging quietly towards the close in very low volume. There was some pre-weekend selling during the final 10 minutes which nudged the price down by a few points and meant that settlement was only a couple higher at 21.58, bringing an eventful week to a close having served to widen the range before ambitions were tempered again.

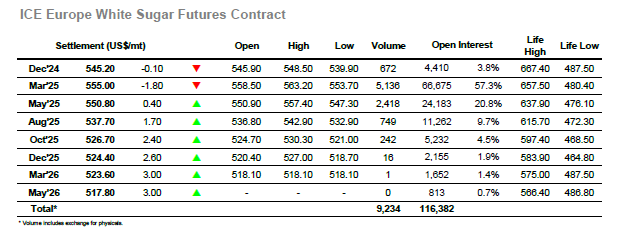

There were light gains for March’25 during early trading as early buying served to support the white premium in the low $80’s against an otherwise quiet backdrop. These were not sustained and across the rest of the morning the price slowly eroded to a low at $553.70 against minimal interest. The afternoon saw a fresh influx of buying with specs ever keen to jump in from the long side and provide some protection to their significant holding and successive waves of buying saw highs achieved at $563.20 before dropping back when their volume dried up. With no other buyers it became a liquidity issue for the longs with day traders closing out during the final period causing the market to begin drifting back through the range again. This exaggerated during the later stages with March’25 trading back into the red and resulted in a lower settlement being recorded at $555.00. White premium values were impacted too as the late weakness left March/March’25 valued at $79.25 and towards the lower end of its recent trading band. Dec’24 saw quiet trading ahead of expiry, with no wild swings for the spread following the orderly close out of positions over the past days. Dec’24/March’25 expired at -$9.80 with Dec’24 settling at $545.20 as 3,822 lots (191,100mt) were tendered, expected to be mostly of Central American origin.