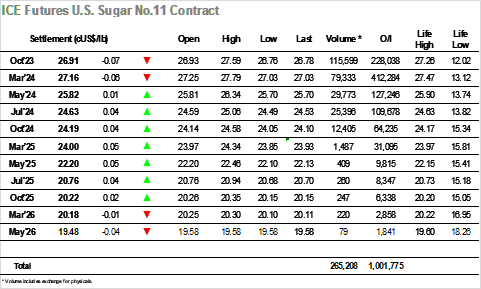

Today No.11 market opened at 26.93, 5 points below yesterday’s settlement. The weaker opening was not enough to stop the positive sentiment over the last days, and specs consistently pushed the market up buying the market. By 10am, market was trading around 27.20 and the following hour was a quiet one, with few movements. Further upsides were seen by 11h30am, when market breached 27.30, and kept acting further with bigger volume pushes from specs. This happened until 12h30, when market reached its daily high, trading at 27.57. The following hour was marked by some profit taking for the specs, that made market come back again to the 27.30 zone. Another push was tried around 2pm but there was resistance as well, as there was some reluctance to keep buying at these levels. The session continued with a stronger correction as we headed to the end of the day, with late afternoon stronger sellers, that brought market again below 27c. Market closed at 26.78, while settlement price was 26.91. Volume traded was 115k lots and VH spread closed 1 point down, at -0.25.

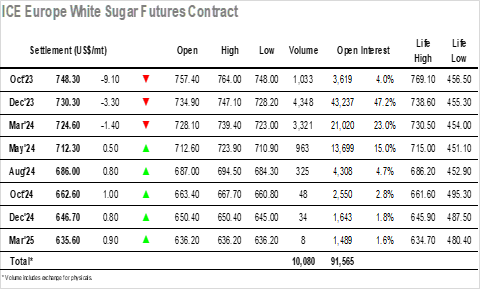

Today White’s Dec’23 opened at $734.9, $1.3 above yesterday’s settlement. Positive sentiment was still active in the market during the morning and at 11am, market was trading at $739.00. In the next hour, market kept its ongoing movement and bigger buying volumes pushed market to daily high, when Dec’23 traded at $747.10. Some profit taking started from that point and in the next hour, prices came back to the $740s. There was another attempt to push traders near 2pm but selling quickly acted on new trades and market saw some weakness from that point until closing, with some gains being realized during the day. Market closed trading at $729.6, settlement price was $730.3, VZ spread settled at $18. The volume traded was about 4k lots. Oct’23 contract expired today settling at $748.3, with a final open interest of 3,619 lots. Volume traded today in the contract was 1,033 lots, with 290 being spreads.