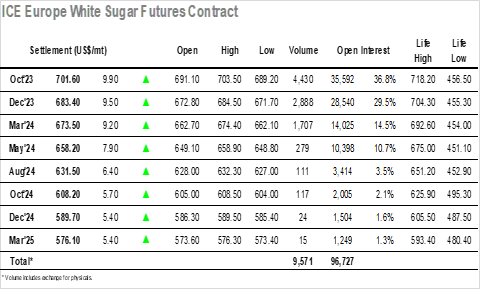

A mixed opening did not hinder the whites for long and quickly the price action moved into positive ground as Oct’23 consolidated the mid $690’s. As has been the case throughout this month the volumes were light, and though some additional gains were made through the rest of the morning the lack of drive hindered the amount being gained. The arrival of some US spec activity helped to push the market further during the early afternoon, and while there was little reason for the turnaround newswise / from the macro the market continued to press ahead through to mid-afternoon. Recent sessions have seen some strange movements for the white premium, and today followed that trend with morning strengthening beyond $170 not being maintained despite the flat price Oct’23 rallying to $702.50. Instead, there was a drop off (likely due to the pace of spec buying for No.11) that sent Oct/Oct’23 back into $166.00 with a couple of hours remaining, though the Oct’23 spreads held steady. A calm afternoon played out until the final stages when buyers emerged to force Oct’23 up to new daily highs at $703.50 and bring the WP back out to $169.00. Settlement was made at $701.60 to leave the former high points at $704.20 / $705.00 back in view.

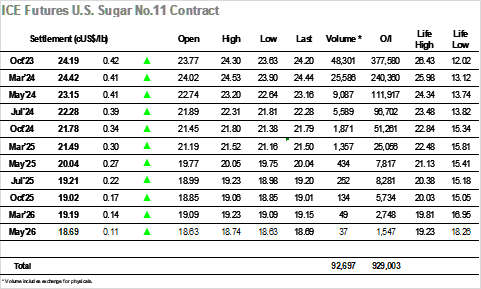

Over the past week Oct’23 has been holding a tight trading band either side of 24c, and following some early selling which pushed the value back to 23.63 the market stabilised to maintain the pattern. Yesterday’s negative close and thoughts of 23.40 was being forgotten as Oct’23 settled down to hold either side of 23.80, building a platform here during the morning from which buyers were able to push the price through 24c early in the afternoon. The initial moved failed to garner momentum but following some long liquidation by day traders there was a second, more successful, move which extended further. Resistance between 24.28/24.40 basis recent highs was challenged and the market reached 24.30 midway through the afternoon before stalling. Still there was no significant fall with consolidation again becoming the theme, though the lack of buying from end users and hedge funds seems set to remain an issue for the time being which will hinder the prospect for further gains. The later stages played out comfortably to the upper end of the range, with Oct’23 closing at 24.19 and while todays showing will provide encouragement for the bulls it remains to be seen whether the necessary buying can be found.