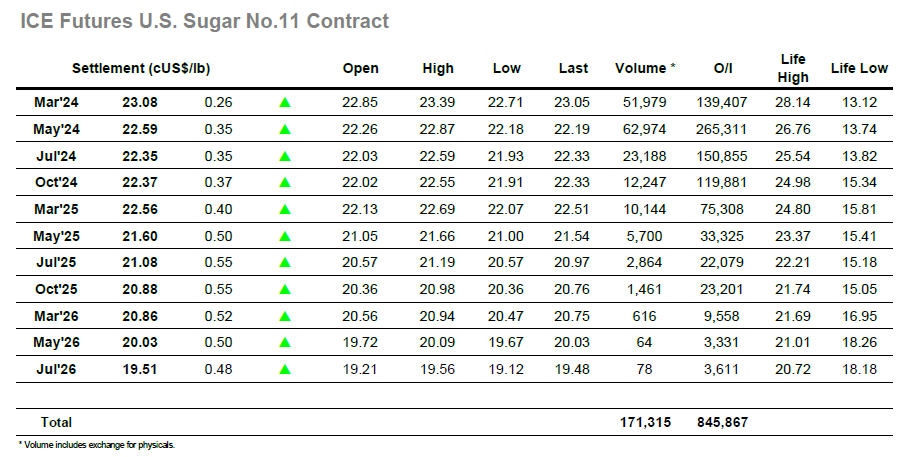

Today, in Mar’24, the market opened at 22.85, which was 3 points above yesterday’s settlement. After the expiration day of H4 options, the market hovered around the 23.00 level. A positive sentiment prevailed from the opening, with the market quickly reaching 23.10 within the first 20 minutes. The price remained near 23.00 for a while. Subsequently, another upward movement occurred, lasting for several hours, reaching the day’s high at 23.39 around 14:40. This was followed by a rapid correction, which was quickly surpassed, maintaining prices above 23.30 for some time. However, in the last hour of trading, the market experienced a drop, causing Mar’24 to close at 23.08, reflecting an increase of 0.26 cUSD/lb (+1.14%) compared to the previous day’s close. The White premium stood at 129.47, and the H4/K4 spread was at 0.49.

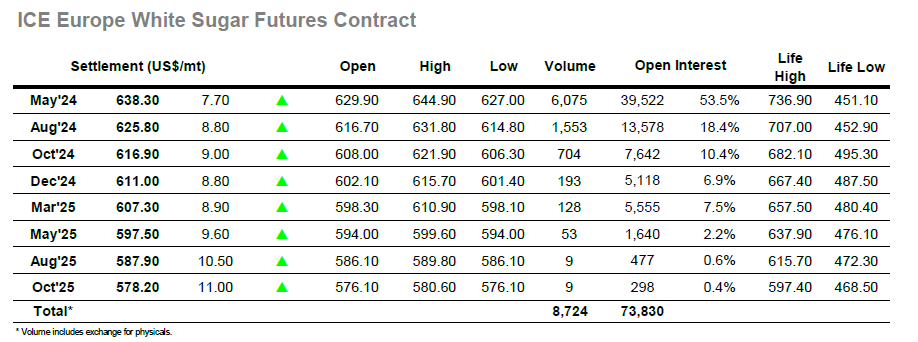

Today, in Mar’24, the market opened at $629.90, experiencing a slight decrease of $0.7 USD/Mt compared to yesterday’s settlement. After a previous day marked by downward movements in the sugar market, the LDN#5 opened with upward momentum, experiencing small fluctuations until 11:30h, when the movement gained strength, continuing to rise until it reached the day’s high at $644.90 around 14:20. Following the movement of the Mar’24 Sugar#11, the LDN#5 May’24 experienced a rapid correction but returned to higher levels, only to decline in the final hour. The settlement price was $638.3, up $7.7 from yesterday’s settlement, representing a +1.22% change from the previous session. May’24 recorded a volume of 6K lots, and the K4/Q4 spread closed at +50.4.