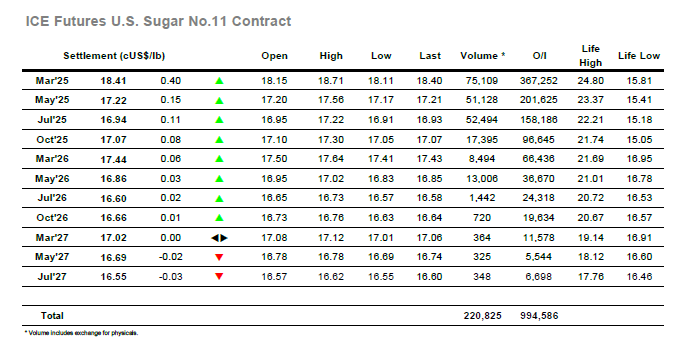

It was a rare sight this morning as Nio.11 values jumped higher on the opening with the bounce continuing through the first couple of hours and taking the March’25 price upward to 18.50. This represented a marked turnaround to recent days with the initial physical related interest spawning some short covering from smaller specs, with quiet consolidation then setting in for the rest of the morning to maintain a sizable portion of the gain. These morning gains also generated some notable movement for the nearby spreads as recent losses were regained at a faster relative rate to the losses with March/May’25 trading up towards 1.10 points in quick time. Moving into the afternoon the morning stability was generating additional buying interest / short covering which extended the daily highs further, and with small traders now playing from the long side and spiking the front month to daily highs at 18.71. This proved to be a step to far in terms of a single day rally and so process retreated to the area of morning consolidation, levelling out to sit calmly at 18.40 as the final hour arrived. Despite this the spreads were sending out more positivity as March/May’25 extended ahead to 1.18 points and provide some encouragement to traders looking to use today as the start of a reversal. Calm trading continued into the close to leave March’25 valued at 18.41, a steady first step but with much work remaining if this is to develop into a sustainable bottom.

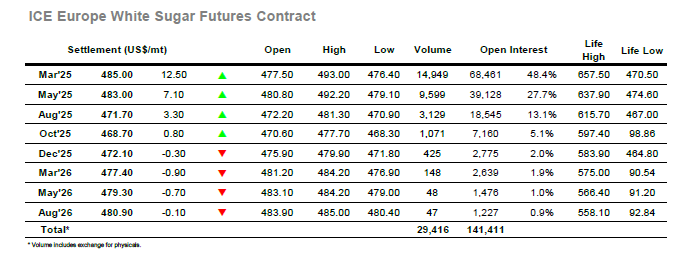

There was a jump higher on the opening as the market followed the No.11 bounce, with March’25 building from initial $4 gains to reach $487.40 (+$15.20) across the following 90-minute period. Such gains were welcome if somewhat unexpected though the pace of movement was never going to sustain with the rest of the morning seeing consolidation at the upper end of the range as we awaited the next input. Smaller traders were clearly satisfied that this represented a little more than the “dead cat” scenario with the early afternoon bringing some additional buying (short covering?) and new highs, while session highs were then recorded a little later at $493.00. This represented a gain of over $20, spot month strength which also brought support to the spreads and arbs where March/May’25 was trading back to a premium with highs at $2.30, while the March/March’25 undid some recent damage in working back over $80. The market did drop away from the highs though maintained a sizable percentage of the gain in holding the mid $480’s through the later part of the day, not spectacular but a base from which to grow should the appetite be there to re-build. Plenty of work remains to be done for this to happen, and having settled at $485.00 the market may see more choppy movement with space to move on both sides without encountering any sizable support or resistance.