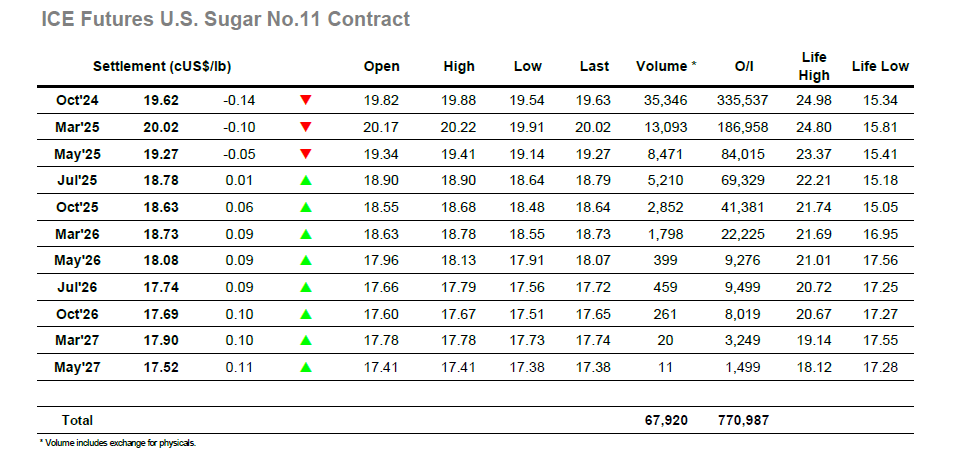

Oct’24 started the day with a brief pop up to 19.88, but unable to sustain this level there was soon some light selling appearing and a retreat into negative ground at 19.60 followed. Volume remained thin throughout the morning as the market settled down to sit within these early parameters with no sign as to where the volume would arrive to break the stalemate. Early in the afternoon there was a small push down to new daily lows and this extended a touch further to 19.54, however the movements were purely being made against small trader activity, reflected in paltry volume that was traded. There was a short covering rally to 19.72 later in the afternoon as the market set back into the range while the final couple of hours played out in negative ground without ever threatening to move very far. Reaching the close Oct’24 was trading in the 19.60’s, with settlement then reached at 19.62 and the Oct’24/March’25 spread valued at -0.40 points as a tedious session concluded.

There was some weakness through the first hour as Oct’24 was pushed back from unchanged opening prints to be trading at $554.60, giving back a little of the ground gained yesterday both for the flat price and the white premium. Things then settled down and for the rest of the morning/early afternoon Oct’24 settled into a band basis the upper $550’s, showing no inclination to move by very far. With Aug’24 expiring tonight and virtually all positions rolled (bar any fine tuning) there was proving to be little to get excited over with traders happy to stand back and observe now that the market finds itself at the centre of this month’s range. The tedium extended through the afternoon, and it was only during the final two hours that a little life returned to proceedings with a push back to opening levels. The daily high was extended by a token amount to $561.10 on the close, though this remained beneath yesterdays mark and left an inside day on the chart. Aug’24 meanwhile was going through its final stages with some wild swings, the Aug/Oct’24 reaching to final trades at $23 premium having been as low as $6.50 earlier today. Oct’24 settled marginally lower at $559.90, with the Oct/Oct’24 arb valued at $127.35. Aug’24 expired at $575.90 with the Aug/Oct’24 spread valued at $16.00. It is anticipated that a small tender of 1,601 lots (80,050mt) will be made with formal details to be published by the exchange tomorrow.