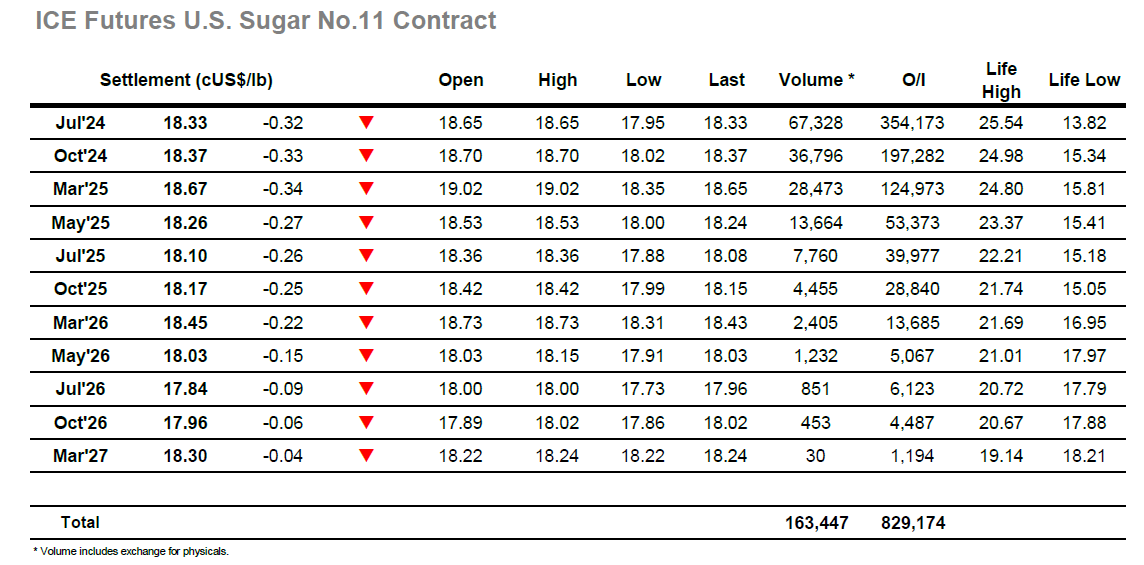

Unchanged opening prints were short-lived, and the market was soon working lower as the recent downtrend again attracted spec led selling. Volumes were light, but that did not hinder the move, and by mid-morning Jul’24 had slipped to sit at 18.31, matching this week’s low and attempting to cling onto support. The efforts were initially successful, but after a while the market cracked, and light sell stops triggered on the way down to 18.11. There was a short period of consolidation through the early afternoon before selling returned as specs looked to search out more stops and inflict additional damage upon the market price. Their efforts yielded a quick push beneath 18c, though the psychological level failed to yield stops and instead a short covering rally ensued. From 17.95 the market worked all the way back up to 18.55, a solid bounce but again lacking any technical reason to alter thinking and bring the more meaningful buying which will be necessary to mount a full recovery. Spreads meanwhile were attracting solid volumes, with good interest all the way down the board from Jul/Oct’24 to Jul/Oct’25. A calmer period ahead of the close saw many traders retreat, before MOC selling (position squaring) sent the market out at 18.33 to extend the current negative trend.

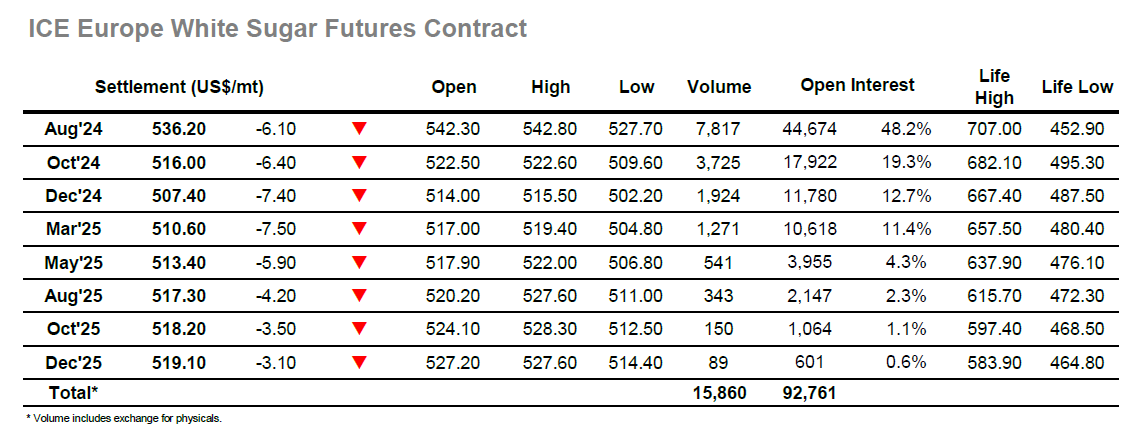

Yesterday’s weak performance gave little reason for any optimism and in quick time the Aug’24 contract pushed beneath $541.30 to record yet more recent lows. The trend was now set lower and through the morning Aug’24 lost ground steadily to a low at $530.30, while the Aug/Oct’24 nudged down to a new recent low at $18.00. The market looked to held through noon and this drew a degree of short covering, however the air of weakness was never far away and so another push ensued, this time bringing the price down to $527.70. Smaller traders only have so much ammunition and there was an inevitability about the covering rally which pulled Aug’24 back up to the $540 area, though once concluded there was no interest from other sectors in continuing the recovery. This left the market drifting for the rest of the afternoon, holding a narrow band and seeing out time until the close. Spreads were able to recover through this period and Aug/Oct’24 was printing back up to $21.90, maintaining a net gain despite outright values being in the red, while for the white premium there was a bounce back to $134.00 for Aug/Jul’24 having slipped towards $130.00 this morning. The closing stages saw some insignificant choppiness, leaving Aug’24 to end the session at $536.20, and extending the weak technical picture.