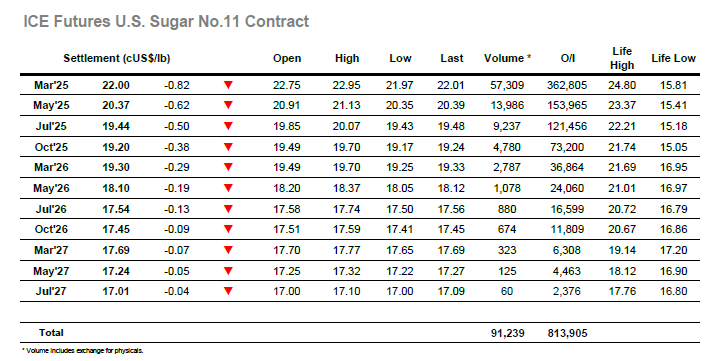

Yesterday’s impressive late rally set the market into a better position to challenge above 23c once again, and early trading hinted that longs were keen to use this opportunity as they support values near to overnight levels. A tight trading band developed which lasted throughout the morning and provided a platform to begin nudging up again ahead of noon with the move growing to 22.95. This placed the market positively ahead of the US morning; however, its arrival did not yield the buying that the longs would have hoped for and so a decline ensued to wipe out all of yesterday’s gains. Hopes that this week’s London gathering would have precipitated a move from the range were now forlorn and specs / small traders will be nervous with more positions being closed out later in the afternoon as another nudge sent the price beneath yesterday’s 22.18 low. The spec dominance of proceedings was highlighted in the volume with only March’25 having traded a 5-figure total reaching the final hour, and while March/May’25 saw the differential crash back down to 1.64 points most of the movement was generated by the March’24 weakness. During the final hour, the market looked to hold above 22c but was ultimately unsuccessful in this aim as the price dipped below on the call and recorded a daily low at 21.98. Settlement was made at 22.00, and while supportive buying is likely to be in place ahead of 21.77 the picture suddenly appears vulnerable again.

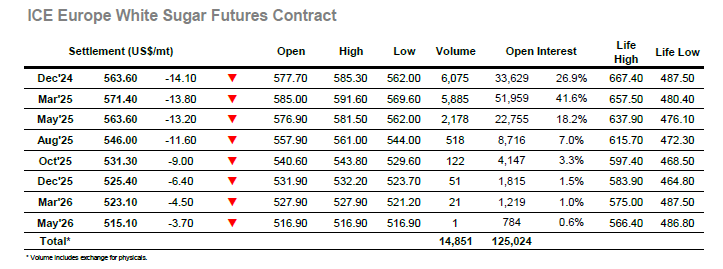

It was a calm start to trading today with nearby values flitting either side of unchanged levels, action to please the longs in the market hoping to cement the gains made yesterday afternoon. The situation maintained for a couple of hours and then built to $585.30, a positive movement which placed the market into some more significant selling and the congestion area from early October and halt the progress. It was not just the flat price appearing buoyant at this stage with the March/March’25 white premium reversing yesterday’s losses and moving up by around $5,though the Dec’24 spreads appeared disinterested and continue to languish at around -$7. Some light profit taking naturally began to creep in and nudge the price back away from the highs during the early afternoon, and though this looked insignificant initially it proved to represent a significant change in fortunes. The decline extended down to $570 before pausing, and the respite was brief as another short, sharp spike registered lows at $563.50. With the market now weak there was more late selling which extended the lows to $562.00, and with settlement made at $563.60 the market looks set to further test downside support.