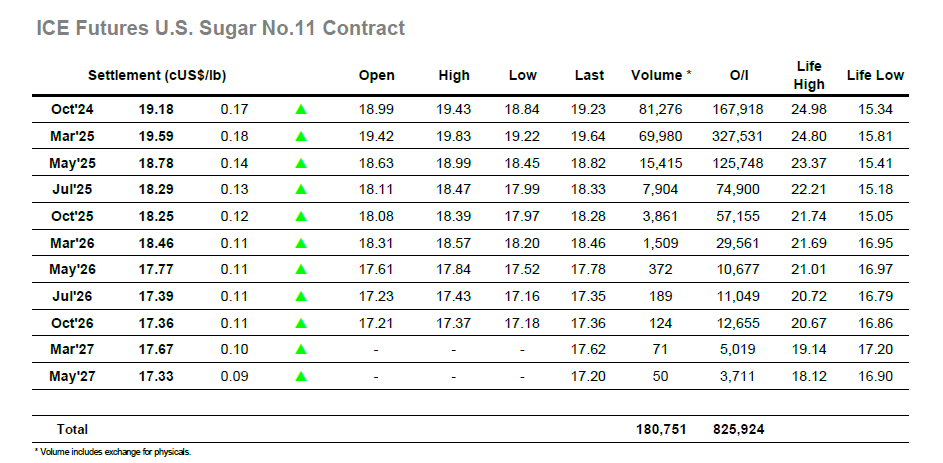

There was a mixed bag of activity across the first hour with nearby prompts trading either side of overnight, and when calmer trading took over the market settled into a narrow band near to 18.90. It was not until we had moved past noon that prices hauled their way back above 19.00, action which proved sufficient to encourage additional flow from smaller trades / specs once the US day got underway. The latest COT report saw mild growth in the spec net short to -19,742 lots, but there was no sign of any fresh selling from this sector as nearby values continued to gain. A mid-afternoon pause did not deter the movements and highs were then recorded at 19.43 for Oct’24 and 19.83 in March’25 to stand the market well with less than 90 minutes of the day remaining. Positivity reckoned without an aggressive correction on day trader liquidation which quickly reduced the gains back to single digits. There were efforts made to reinvigorate the market during the closing stages, with 19.25 appearing a target for the Oct’24 option expiry, though we ended the day a little shy of this mark at 19.18 for Oct’24 while March’25 settled at 19.59. Overall, this leaves the market still positioned within the range though showing a healthier glow than on Friday.

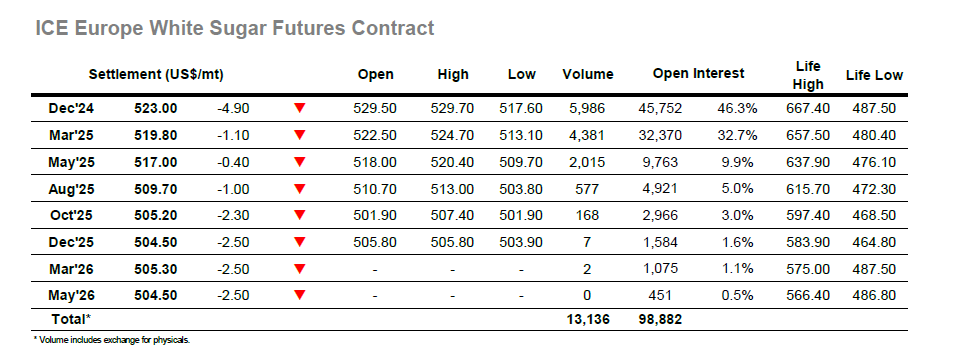

Dec’24 commenced its tenure at the top of the board with a sharp early drop, losing around $9 across the first 30 minutes and causing both spread and white premium values to decline. A hint of support followed but the respite proved to be brief and by the later morning there were fresh lows being registered at $517.60. The lack of supportive interest was obvious and though the market looked to pull back up as the afternoon got underway it was merely being hauled along by the No.11 with the white premium values continuing to suffer. Dec’24 eventually clawed back into credit with a high at $529.70 but it remained a deceptive reading with the headline March/March’25 white premium trading around $6 lower in the $87.00 area. Prices fell away again as the final hour arrived as long liquidation took place into a thin market to leave plenty of red on the board heading into the close. Dec’24 remained in deficit on the call with settlement recorded at $523.00, while Dec’24/March’25 closed lower at $3.20 with March/March’25 recovering a touch to be valued at $88.00.