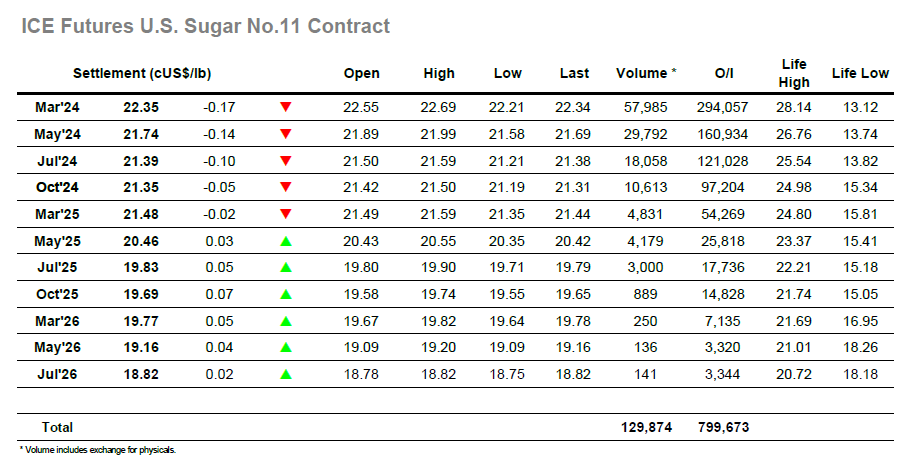

It was a calmer start to proceedings today as in initial buying soon eased with the market retreating from an early 22.65 high top sit marginally lower in the 22.40’s. There was no sign of obvious spec activity during this period, however gradually they did return to the market to bring March’24 away from its 22.38 low, adding to longs as the price pushed steadily upward to 22.69 while also helping March/May’24 up to 0.70 points. The specs would have hoped that moving above yesterdays 22.64 mark would generate some fresh inflows of buying however this was not the case and instead the market simply entered a consolidation pattern to edge into the afternoon around the 22.60 mark. Across the following hours further attempts were made by the smaller traders to test the highs, but despite matching them they were never able to draw any larger fund activity to the environment and so the market continued to trade either side of 22.60 on decreasing volumes. With progress having stalled there were questions as to how long the specs would hold their positions, and the answer emerged during the later afternoon with a liquidation driven plunge to 22.21. the market now looked vulnerable however there was some buying / short covering during the final hour which prevented further losses and left March’24 closing away from the lows at 22.35.

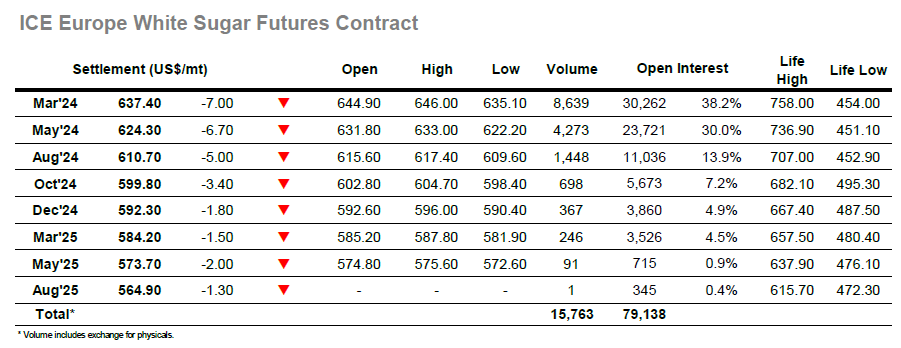

This week has seen white sugar values making rapid gains, and there was another higher opening today with March’24 printing up to $646.00. This level was shy of last night’s high however and with specs not showing as willing buyers initially the market set back to the $640 area before looking to consolidate. A period of calm followed with the market then re-gathering to push back up to the $645.00 area by the end of the morning, as small specs looked to energise the picture ahead of the arrival of US based traders. Their efforts did not achieve the aim as the market proceeded to stall shy of the morning highs and then meander sideways over the following hours, suggesting fatigue that will have discouraged buyers from further bolstering the spec longs. This fatigue was also evident in the spread and white premium movements, with the nearby March’24 premium having struggled to maintain its recent gains from early this morning and trading back beneath $144 during the afternoon. There was a sharp fall to $635.10 as longs raced for the exit, and this left the market weaker for the remainder of the session. Settlement was away from the lows at $637.40, and while it does not spell the end of the resurgence it does show that continuing progress may not be as easy as some had hoped.