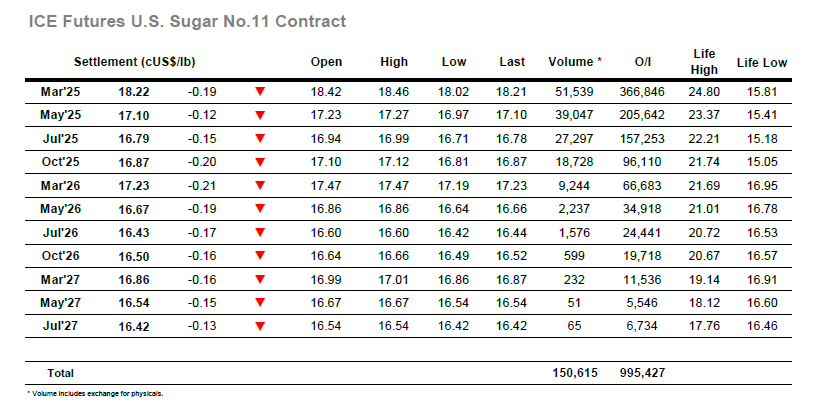

Slightly higher opening prints were quickly forgotten as March’25 quickly slumped back into the 18.20’s, making it apparent that yesterday’s efforts did not have any continuation interest and leaving the market with a vulnerable appearance again. For the next couple of hours the market bumped along sideways, but with buying hard to find the sentiment was the driving factor in the next movement when day traders pushed lower and started to investigate the underlying support. It was only in the 18.10 area that a little more support was found as some light pricing orders started to appear ahead of the 17.92 low, and with the selling lacking any real punch this proved to be sufficient for prices to hold in front of 18.00. Lows were recorded at 18.02 along the way, though outright volumes were small with interest fading and fewer positions being taken ahead of the 3-day weekend. The lower values did impact the nearby spreads with the March’25 focus sending the March/May’25 back to 1.04 points at one stage, though the value recovered later in the afternoon and remained a good distance from the recent lows. It was a calm end to the week with March’25 quietly moving along within the range to settle at 18.22, and with March/May’25 valued at 1.12 points the picture was not as bleak as it could have been despite the inherent technical weakness which remains. With the market closed on Monday we now turn to both the COT report and white market to see how they may influence thinking ahead of Tuesdays resumption.

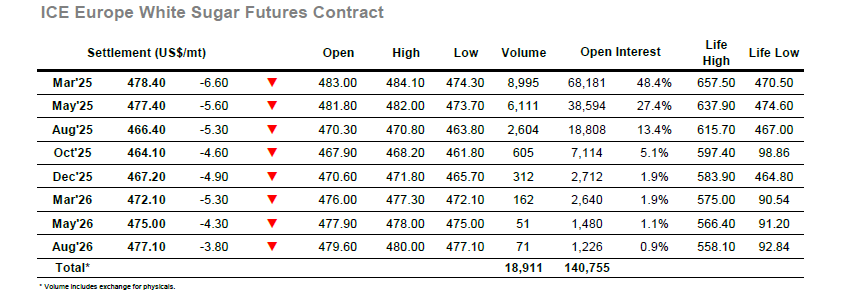

It was a sloppy opening for the whites as the market dropped back by a few dollars in response to a weaker No.11, with any optimism from yesterday’s recovery fading away as the market reverted to its recent type. Initially March’25 was able to consolidate in the lower $480’s but with buying proving to be limited there was a push down later in the morning which took the price back below $480 and on a path to a daily low at $474.30 as day traders again looked to trade from the short side. This placed some pressure back onto the March/May’25 spread although it didn’t haemorrhage and remained at a premium throughout the day. The white premium was not standing up so well with March/March’25 giving away most of yesterdays gain as it returned to $76.00, though the weakness was relative to the No.11 as the outright market continued sideways through the afternoon. March’25 remained in the $477.00 moving into the final hour as it struggled to pull far from the lows, and despite some pre-weekend position squaring the settlement t $478.60 leaves it still vulnerable heading into next week. Monday see’s No.11 closed for a public holiday, potentially providing opportunity for more movement with no outside factors to influence.