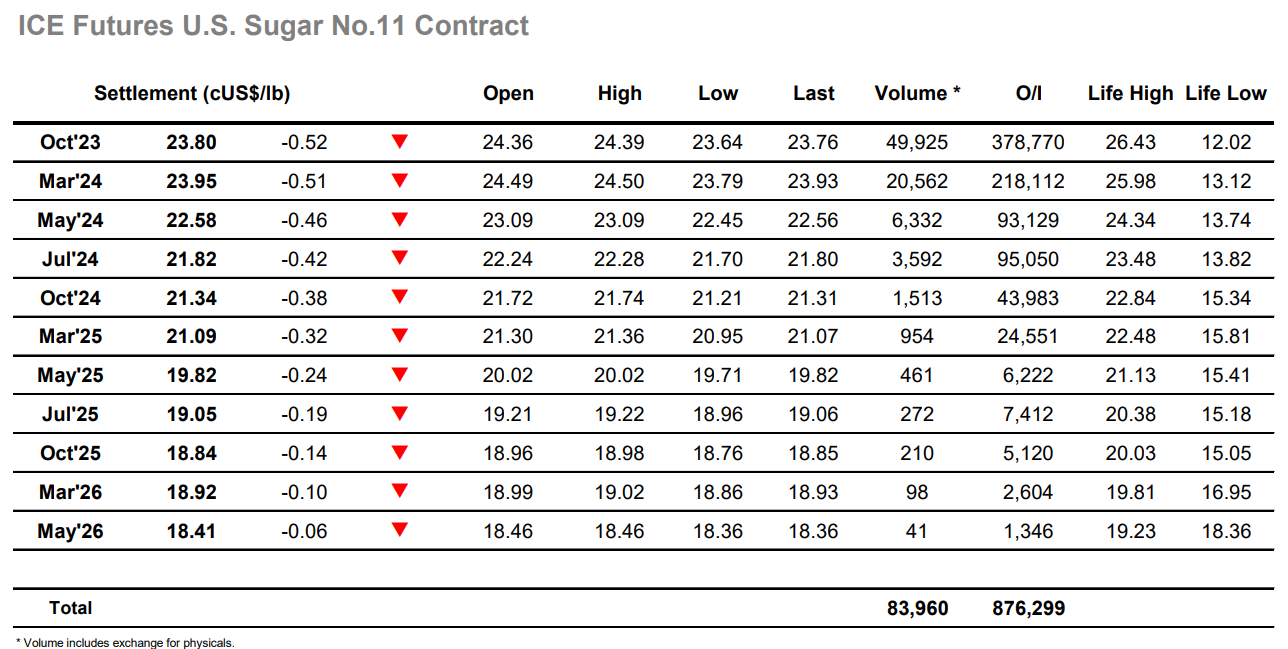

Looking to build upon last week’s stability the market commenced marginally higher, though this soon gave way as the lack of buying allowed the market to fall back with Oct’23 slipping to 24.07. There was a brief push back upward from longs midway through the morning however on low volume this failed to build any momentum and the market eased back to drift along quieting in the 24.10 area. Fridays’ COT report showed a small reduction in the net spec long to now stand at 114,608 lots, and while there may well have been some addition to this from the smaller specs late last week it seems that the unwillingness of the hedge funds to buy currently is hindering the efforts at recovery now the price has recouped more than 50% of the late June losses. Recent higher moved have been driven during the afternoons however there was no such move today as the arrival of US traders drew in some additional selling which sent Oct’23 slipping back beneath 24c. Most consumer buying interest remains some way beneath current levels and so the market continued to soften despite only limit selling and reached a low at 23.64 midway through the afternoon. Interestingly given the contrarian nature of the Oct’23/March’24 spread on the recent rally there was no weakness seen today, remaining near to unchanged before settling just a point lower at -0.15 points. Oct’23 meanwhile closed at 23.80 having consolidated the lower part of the range through the final two hours, an unremarkable performance which may confine activities to the range again for the time being.

- Since seeing lows at $609.60 on 29th June there has been an impressive resurgence for the whites market, the pace of which was impressive leading into the Aug’23 whites expiry. Though Aug’23 expired at $700.70 there was no follow on buying for Oct’23 this morning and so for the first time in a while the market came under a little pressure with Oct’23 slipping by more than $9 to $676.50. There was subsequent consolidation which prevailed through the rest of the morning; however, the tone had changed, and buyers were suddenly proving hard to find. By early afternoon, the market came under renewed pressure with apparent spec liquidation sending the price lower again and bringing $670.00 into view. The weakness was being felt through the spreads also with Oct/Dec’23 more than $4 lower on the day, while the Oct/Oct’23 white premium that had been so firm in reaching $150 on Friday was giving some of the gains back and valued near to $144.00. Buyers remained limited to scales and with nobody stepping up to the plate we saw the decline continue right the way through until the close, Oct’23 settling at $669.40 before trading a new session low $667.70 on the post close.

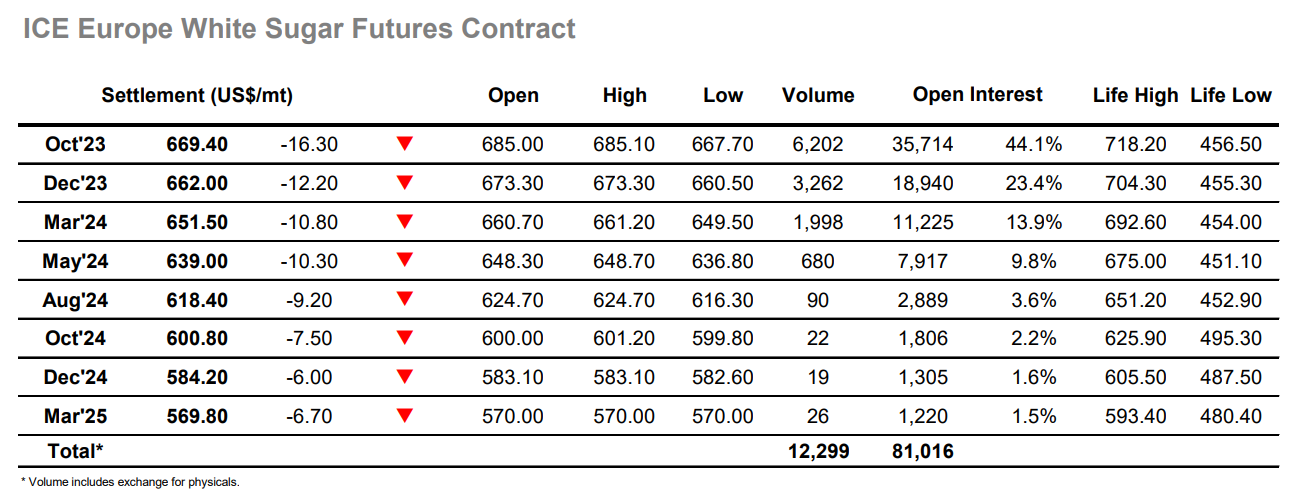

- Aug’23 settled at $700.70, with Aug/Oct’23 expiring at a $15.00 premium. A total of 2,485 lots (124,250mt) was tendered with details shown below.