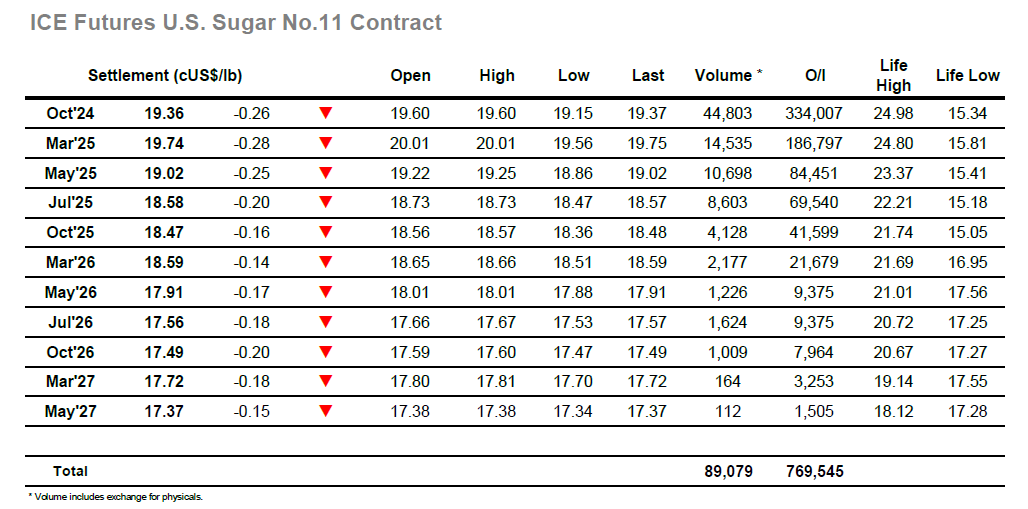

There was a sharp drop on the opening as Oct’24 quickly lost 20 points, and this set the tone for the morning. Trading then settled down into a relatively narrow band with Oct’24 tracking along either side of 19.40 for the rest of the morning and showing no desire to push very far. The afternoon saw a little more life brought to proceedings as the market came under additional pressure and slipped to 19.15, though the movements were being solely generated by the smaller traders and so was followed by a short covering rally which extended all the way back to 19.50. Volumes were marginally better than seen yesterday due to these movements but remained below average and were not helped by a return to narrow trading during the final two hours. The market edged along in the 19.30’s, leading to a close for Oct’24 at 19.36 and Oct’24/March’25 at -0.38 points with the current quiet conditions likely to extend into tomorrow.

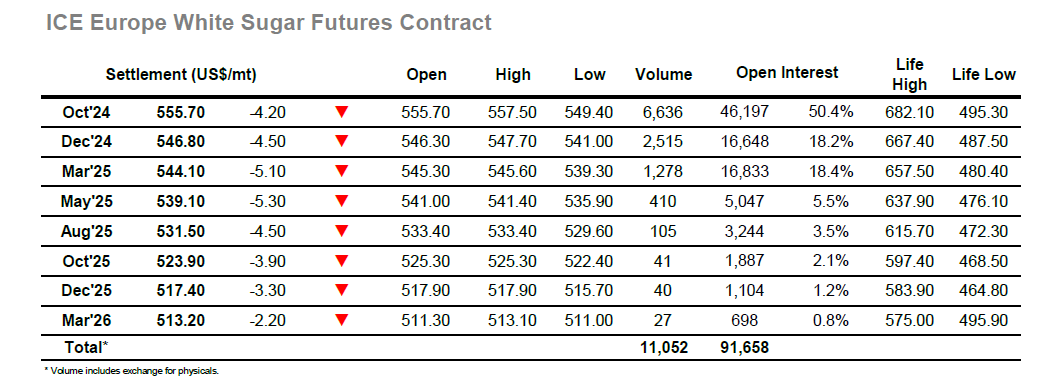

The market gapped down on the intra-day chart with an opening at $555.70, and additional pressure was applied through the early part of the session to extend the losses. Trading was quiet as the market looked to stabilise, however Oct’24 was lacking consistent buying and so by early afternoon the price was again breaking new daily ground with a drop to $549.40. This proved to be the low mark with a rally following soon after against short covering, in turn recording new daily highs at $557.50 before thing settled back down. It wasn’t just the flat price which was quiet as white premium values saw a more settled range also, working a couple of dollars either side of overnight against the small trader movements for both markets but generally consolidating the recent recovery in value. The latter stages played out comfortably within the range as Oct’24 moved to a settlement at $555.70 while Oct/Oct’24 saw another firmer close at $128.90.