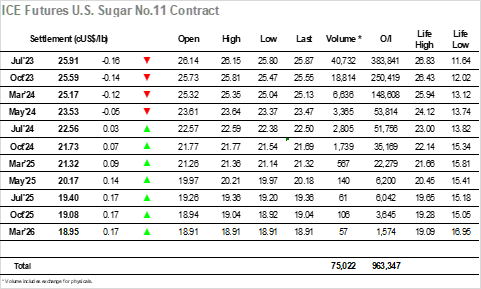

Early trading took place either side of unchanged values, however it was not long before the market started to test lower with a dip into the 25.90’s. It seemed to be that yesterday’s failure to hold gains had encouraged day traders to check out the downside instead, and they maintained an element of pressure through the rest of the morning with the price action taking place beneath 26c. A little more selling emerged in line with the US morning to send the price to 23.80, but despite moving 3 points beneath Mondays low there was no reaction/stops and so an inevitable short covering rally followed back to 26.11. Volumes were dire throughout the session with nearby spreads again showing little change (Jul/Oct’23 at 0.34 points, Oct’23/Mar’24 at 0.43 points) and while there was reportedly some volume changing hands for the nearby white premium the volumes were not of significance to the wider No.11. The remainder of the session played out within the lower half of the existing range, a weaker showing in comparison to recent efforts but one which continues the broad sideways consolidation that has prevailed through this month with Jul’23 eventually settling at 25.91.

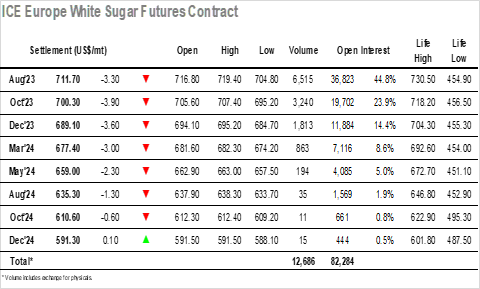

A spike higher to $719.40 on the opening provided a positive start to the day, though with no other support forthcoming and No.11 showing no intent to rally in the same way the market soon eased back to sit near to overnight levels. There was not the same enthusiasm being seen from the long side today and so the rest of the morning/early afternoon became a grind back down through the recent range to a low at $704.80, before rallying sharply when the day trader shorts decided that they had had enough. Outright volume was again sparse, with the numbers only boosted by some block trades being registered for the Aug/Jul’23 white premium in the upper $130’s, while Aug/Oct’23 spread trading took place between $10-$12 to maintain current levels. Having recovered to $715 the market again cooled to sit lower, though the boundaries of the range were not threatened again leaving prices to edge quietly toward the close. There was no reaction to either side on the call, emphasising how even the day traders had found apathy through the final stages, with Aug’23 settling at $711.70 to leave market parameters unchanged.