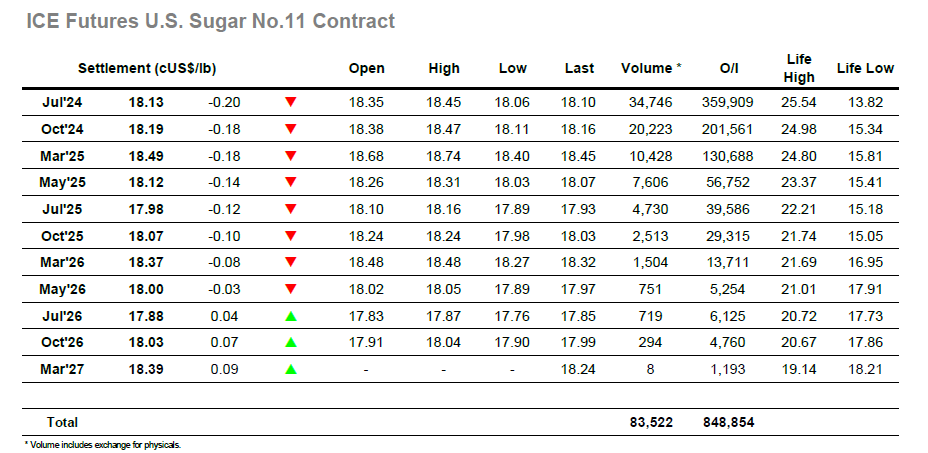

The market retains an air of weakness currently and despite some light overnight buying which pulled nearby values a little higher during the early stages the market was lacking support and so within a couple of hours was sitting down in the 18.20’s.Volumes were paltry, and on the light activity which did emerge it was the short side driving movements and edging the Jul’24 contract further south. This left the market vulnerable to another look at yesterdays 17.95 low, although the limited spec selling which arrived with the US morning only sent the price to 18.06 and so left this area unchallenged. There was some corrective short covering which pulled prices a small way back from the lows, but generally the market remained weaker with selling returning through the afternoon to match the lows. Open interest increases suggested that yesterday’s heavier volume had drawn in fresh positions from both spec shorts and consumer longs, though today’s efforts will likely not change these numbers by much more. What will be interesting to observe is the COT report tonight which will likely show another increase in the net short holding for the specs, with questions possibly then being asked as to how short the sector may go should the larger funds maintain their lesser involvement with sugar. The closing stages played out ahead of the lows, leaving Jul’24 to settle at 18.13, providing a weak close for the weekly chart as eyes turn to the aforementioned COT numbers.

White sugar has been leading the way downward this week as reflected in the weaker white premium value, though today we commenced in contrast to this pattern with Aug’24 jumping by more than $5 during the early stages. This widened spread values out with the buying focussed on the top of the board, and for 2025 positions we were only seeing mild gains for a short period before returning into the red. With No.11 under pressure there was an abrupt pullback for Aug’24 as the price shot down to $534.00 on only mild selling, however, there still was not the level of selling seen earlier this week and the picture was able to stabilise. Moving into the afternoon there were marginal new lows recorded, however the level of selling was more limited than recent sessions and so the relative stability of the market maintained, illustrated by a recovery for Aug/Jul’24 to $136.00. Moving along quietly towards the close there was a matching of the earlier $533.20 low but little else to get excited over with most traders simply counting down the minutes until the weekend. A quiet close saw Aug’24 ending at $534.70,while Aug?Oct’24 was at $20.20 and the Aug/Jul’24 arb at $135.00.