A wild opening saw Jul’24 printing between 19.57 and 19.21, though activity soon settled down to a band in the 19.40 region allowing for some consolidation following the relentless losses over the past two weeks. Trading was quiet over the rest of the morning though prices did track a little higher with additional short covering / profit taking emerging in light of the consolidation, and with sellers hard to find at current levels this provided the basis for new highs to be recorded early in the afternoon. Jul’24 extended to 19.71 before the buying eased, and a return to the range followed on day trader activity. The afternoon then developed into another pattern of rangebound consolidation, values holding slightly higher than this morning and pivoting around 19.50 but with no activity of note taking place. Spreads too were quiet as the session meandered quietly along with May/Jul’24 remaining at a small premium with less than a fortnight until expiry. There were no fireworks for the close as traders stood back amid the relative calm to leave Jul’24 at 19.54, and should the specs remain less involved as was the case today the market will likely look to hold into the weekend and try to establish a bottom.

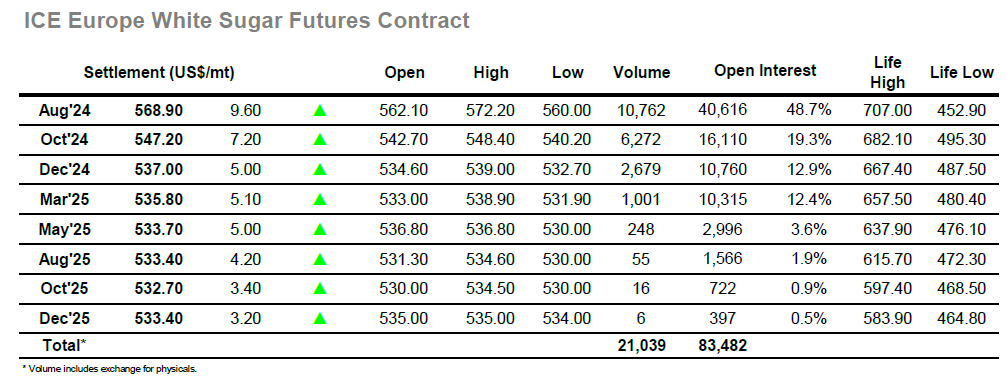

The whites enjoyed a rare higher start this morning, and though the gains were cut with a dip back to $560.00 the Aug’24 contract was generally solid. This provided a good base from which the market could finally try and regain a modicum of this month’s lost ground and over the course of the morning the price edged steadily upward to the $565.00 area. From this base the market accelerated ahead around noon to a high at $572.20, aided in no small way buy another round of buying for the nearby spreads which saw Aug/Oct’24 pushing back out to $25.00. This in turn pulled the Aug/Jul’24 white premium up by several dollars to the upper $130’s, an unexpected reversal given the activity this week after May’24 expired. The highs were not maintained but the general stability of nearby spreads and arbs remained, although the situation was much flatter for the middle months. Following an extended period of consolidation the Aug’24 nudged back above $570.00 and remained in this vicinity heading towards the closing call. The market let go on the call as end of day position squaring took place, leading to a Aug’24 settlement of $568.90 while Aug/Oct’24 closed at $21.70 following some late selling. This provides a basis from which the market can try to build a bottom though there remains work to do yet with the technical picture still weak.