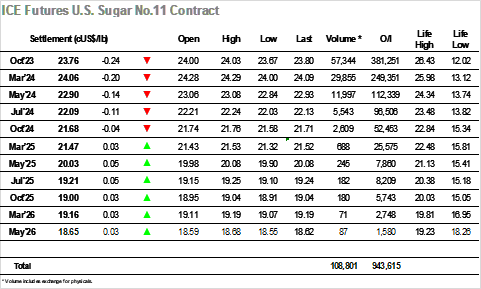

Mildly higher opening prints quickly gave way to losses as the top of the board with some aggressive selling hitting the Oct’23/March’24 spread during the early stages, more than 3,000 lots changing hands during the first 15 minutes as the value slumped to -0.34 points. The spread was then able to dig in and hold though the lead provided by it in sending Oct’23 lower rippled down the board with all positions trading negatively through the rest of the morning. With no sign of support from the specs the market continued to struggle into the early afternoon, dropping through 23.80 and continuing to edge down into the underlying support. Consumers remained buyers on scale, and this limited the size of decline, though the market remained weak in stark contrast to most of the macro (maintaining a recent contrarian / independent theme). There continue to be headlines surrounding EL Nino and Brazilian logistics which the bulls will be sure to try and utilise, but for today at least there was no sign that these would spark a recovery, maybe the specs have taken too much pain this week and didn’t have the appetite for another change of direction. Lows were recorded at 23.67 during late afternoon, with some late position squaring sending Oct’23 out at 23.76 to conclude the week.

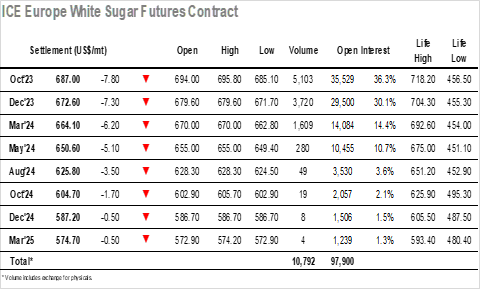

The retreat yesterday afternoon had damaged confidence leading to a lower opening, and though there was some defensive buying to follow which briefly took Oct’23 back up to $695.80 the trend continued lower with day traders pushing the price back down. It was not until $690.00 that any sizable support was found, this level providing the morning low with values sitting quietly just ahead of it. The trend continued lower into the afternoon, movement proving to be slow and steady as the market ground down through some consumer / end user pricing in the upper $680’s. By now we were also seeing the spreads come under a little pressure with Oct/Dec’23 giving back more of the recent gains to trade at a $12.30 low while the Oct/Oct’23 white premium slipped beneath $163.00 intra-day. Oct’23 lows were recorded at $685.10, one-week lows just 24 hours after recording three-month highs, with values continuing at the bottom end of the range moving through the final hour. There was little change until a choppy final 10 minutes, Oct’23 heading into the weekend at $687.00 and seeming likely to maintain the broad range for a while yet.