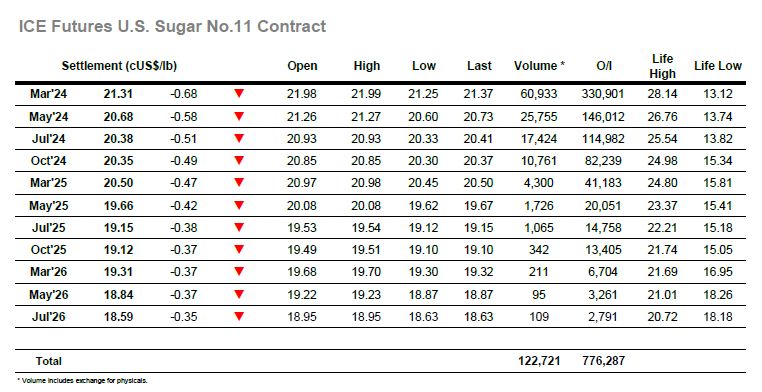

An unchanged opening quickly eroded away as the market took on a familiar look with a sea of red showing down the board. Friday’s COT report had shown a reduction in the net speculative long holding to 50,187 lots, halving the holding across the 5-day reporting period though still representing a longer position than many had anticipated. Maybe it was this factor which encouraged the day traders to push the short side yet again in the belief that there will be further position liquidation to come, but whatever the reason there was little buying in place to stem the decline as March’24 plunged to 21.29. Additional selling sent the market to 21.25 soon afterwards, however that proved to be the low with some more substantial buying emerging ahead of last Thursdays 21.14 low mark. What then followed was several hours of sideways trading with the underlying consumer support providing the base from which the market struggled to escape. On two more occasions through a calmer session the market matched the morning low, but each time it held firm and ensured that the market did not collapse for today at least. The second occasion was as the close approached and so a weak settlement was posted at 21.31 though whether this leads to a test of 21.14 tomorrow, or if the consumers can again support proceedings, remains to be seen.

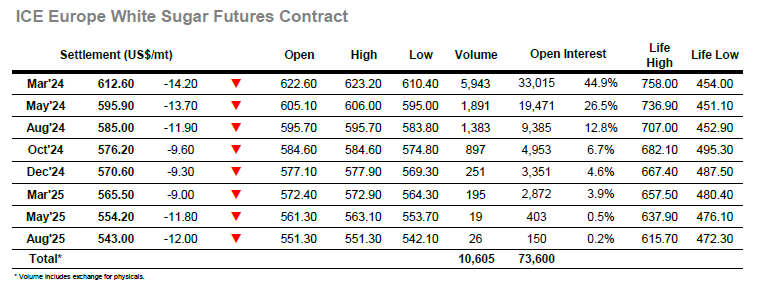

Following the lead set by No.11 there was an immediate fall in prices this morning which continued through the first hour with spec led selling looking to generate movements once more and sending March’24 marginally beneath the recent $611.20 mark to a new recent low at $610.40. Buying then started to filter through with consumers/end users leading the way, while day traders saw this as a cue to cover back early shorts and reassess. Recent sessions have seen the market chop around continuously however today was calmer with prices spending the rest of the session within the lower confines of the early range. It was telling that the flat price was struggling to recover with the buying mostly confined to underlying scales / limits, and with many funds now liquidated ahead of year end this may be a sign of things to come as the Christmas holidays approach. Spreads were under an element of pressure due to day traders playing the March’24, though didn’t collapse with March/May’24 ending the day at $16.70 while the March/March’24 white premium soldiered along in the lower $140’s. There was selling found ahead of the close to push March’24 back to settle at $612.60 but that aside it was the most non-descript session seen for some time. Tomorrow will likely see the lows tested again, possibly a key indicator as to whether the market may find some respite moving in towards the holidays,