Initial trading either side of overnight levels was unconvincing, and it did not take long until small traders began to tick the market lower as they looked to continue yesterday’s movement. Lows were recorded for Oct’24 at 18.88, but this was above yesterday’s 18.81 mark and with more consumer buying emerging some cover was taken to leave prices drifting along near to 19c ahead of the US morning. With the decline stemmed, there was some fresh effort to push the market higher again early in the afternoon with Oct’24 moving up to 19.23 as a result, however it all felt very lacklustre, as reflected in the modest volumes, and when long liquidation took place, we were quickly back to the 19.00 area once more. Spreads were seeing more modest volume, as expected with only seven sessions now remaining until the Jul’24 expiry, and there was limited movement as the discount maintained to leave Jul/Oct’24 little changed at -0.07 points. A calm period heading into the close was only broken by late position squaring ahead of tomorrow’s market holiday, meaning an Oct’24 close at 18.99 which leaves parameters unchanged for Thursday barring any dramatic white’s movements in the meantime.

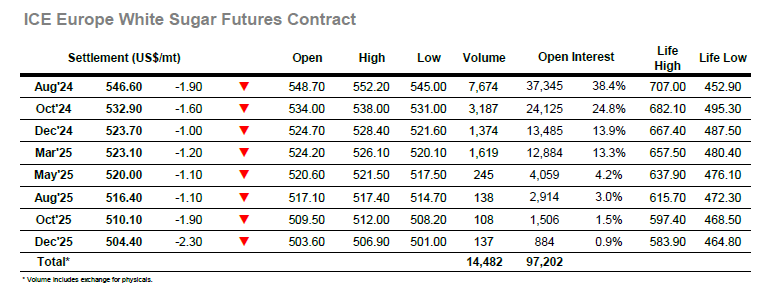

There was a continuation of yesterday’s lower movement on the opening as Aug’24 immediately slipped below $546.00, and the pressure was maintained through the first 90 minutes to register lows at $545.00. The lower levels saw better buying than had been in place yesterday and so following a period of digging in its heels the market found its way back to overnight levels where it calmly saw out the morning. This presented the first real opportunity this week for those of a positive persuasion to try higher and their efforts saw prices up into the lower $550’s for a period, but the move lacked substance and by later afternoon we were again seeing nearby values back in the red. Aug/Oct’24 was trading marginally lower as rolling continues, though the volume was milder today, while the white premium showed no inclination to bounce back with Aug/Oct’24 remaining just beneath $130.00 and Oct/Oct’24 around $114.50. The closing stages drew some selling which sent Aug’24 down to settle at $546.60, maintaining this weeks negative theme with possibly more pressure to be applied tomorrow in the absence of No.11 due to the US market holidays.