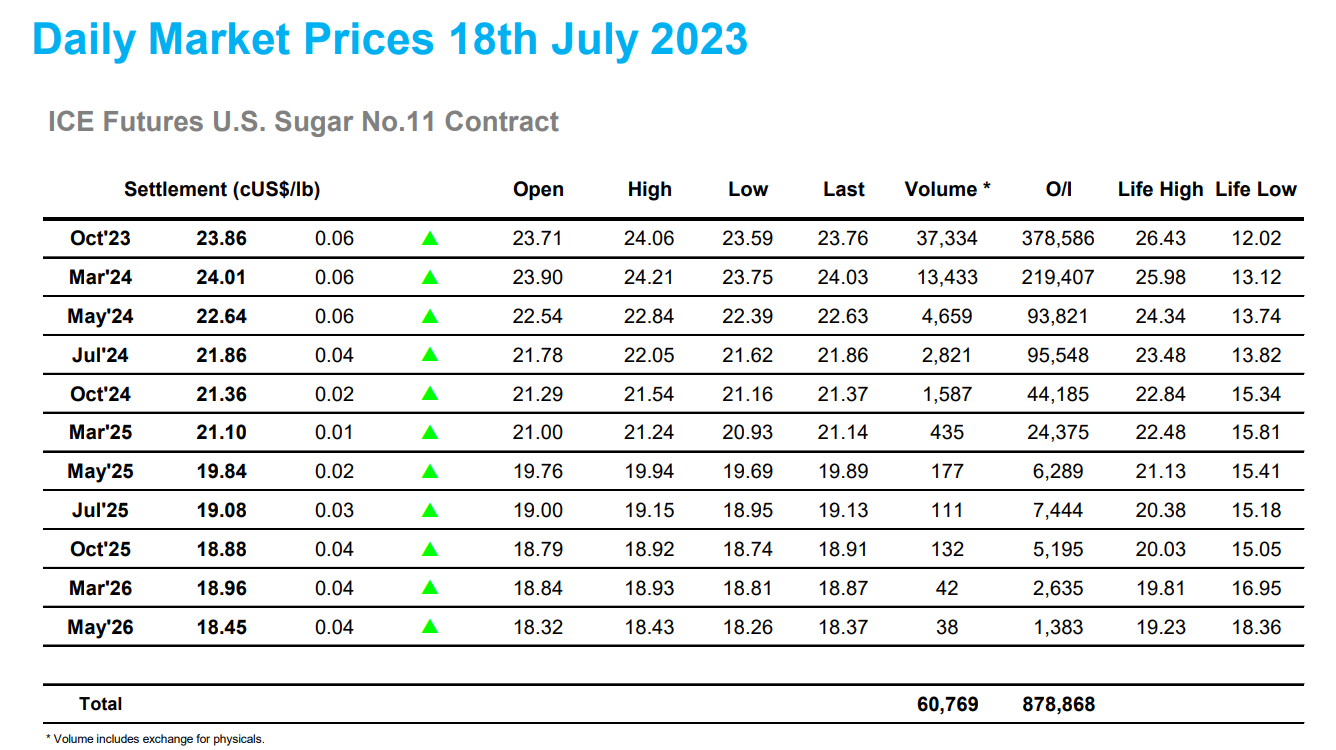

Yesterday’s performance was the first time in a while that the lack of buying from consumers has become an apparent issue, with the specs seemingly running out of ammunition to keep trying to bid the market back up. There was a small hangover from that performance initially this morning as Oct’23 traded down to 23.59, however this seemed to be driven by day traders and with no selling following behind the market returned to sit closer to 23.80, remaining within proximity of unchanged levels through the rest of the morning. The specs have never been known to give up easily in their efforts and so a spike up to 24.06 during the early afternoon was of no surprise, but as with the morning dip there was again no substance to the movement and prices once more returned to the range. As the market settled back into quiet trading it was not just the flat price that saw volume wilt, with spreads too seeing only minimal activity as Oct’23/March’24 held within a couple of points of unchanged on very light interest. The remainder of the session saw price action firmly confined to the range, only Oct’23 seeing any volume as the market meandered to a mildly higher close at 23.86 which leaves the current rangebound prognosis unchanged.

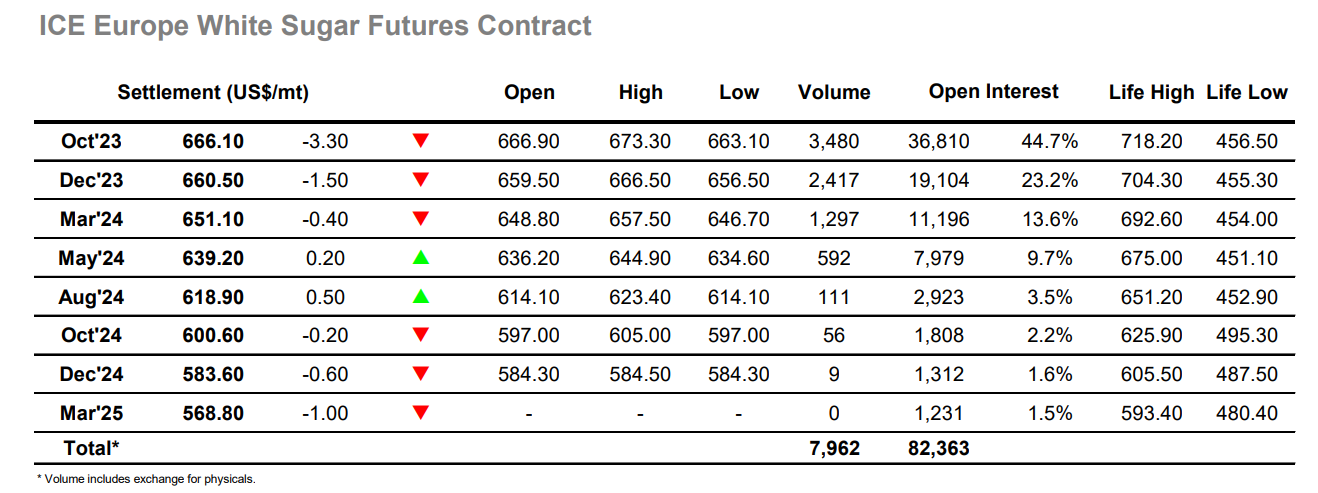

The day commenced with a sharp plunge to $663.10 for Oct’23, reacting to weakness in the No.11 market and finding no support with scale orders remaining limited to both sides of the market currently. The picture soon levelled out and a morning of spotty trading panned out basis the upper $660’s, providing some encouragement to recent buyers though with the market still lacking an obvious spark to get things going again. There was a small push up to $673.30 during the early afternoon, however this turned out to be a hinderance to the efforts of the longs as subsequent liquidation sent the price tumbling back through the range to the mid-$660’s where another consolidation pattern emerged. Alongside the flat price movement there was another cooling in the white premium values with Oct/Oct’23 giving back more of the recent gains and returning to $140, though this was more of a paper valuation basis a lack of buying than a reflection of any significant market activity. A calm afternoon then played out within the lower half of the established range, a late effort at dressing the price back up by longs ending in failure with a lower settlement made for Oct’23 at $666.10.