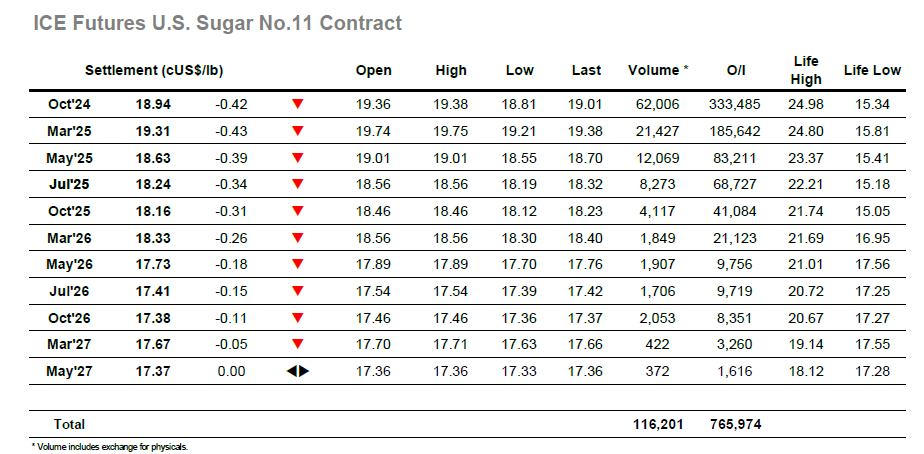

It was a quiet start to today’s session though before long some light pressure started to be applied and send Oct’24 down into the 19.20’s. Monday’s rally had given longs some fresh belief however the action of the past two sessions has undermined this and so the smaller traders have started to eye up the recent lows once more in hope of generating opportunistic movement. For a few hours the price maintained calmly in the 19.20 region but as the afternoon got underway, so some pressure started to be applied from US based specs, sending the Oct’24 contract down to challenge this month’s 19.07 low mark. The market traded a single point beneath this mark but then rallied on short covering, however that did not prove to be the end of their efforts and selling followed back in a couple of hours later to probe further. This next move saw additional extension with Oct’24 spiking down to 18.95 on around 3,000 lots, and though there was a pause to follow it did not mark the end of the losses. Through the final hour Oct’24 saw lows at 18.81 to mark its lowest traded price since 17th June, before some late short covering took the price away from this mark to settle at 18.94, a still weak number which may lead to more support testing tomorrow.

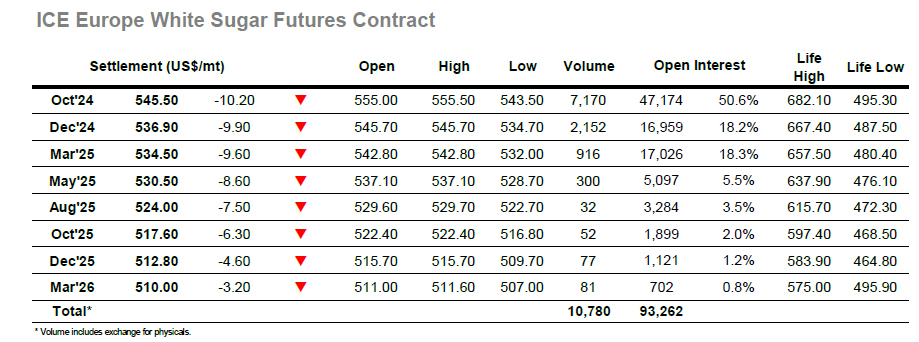

The market has lost some of the shine garnered from Monday’s recovery and so a sloppy start which saw values fall back into the lower $550’s was no great shock with many traders suffering from apathy. The picture remained unchanged until noon when a little more pressure started to be applied, and in the quiet conditions the selling sent prices back as far as $547.30 before some short covering halted the movement. This pause in the decline paused the fall of the white premium also with Oct/Oct’24 having been trading back around $126.00, though the Oct/Dec’24 was showing little change and remained near to $9.00. Another push down later in the afternoon sent prices through the earlier lows, with the trend continuing to break downward across the final couple of hours. Oct’24 bottomed at $543.50, still a few dollars above its lowest level this week sue to the stability of the white premium with Oct/Oct’24 having returned to the $127.50 area. The closing stages saw some end of day position covering as Oct’24 settled at $545.50, but despite remaining within recent parameters there is an air of vulnerability which may lead to some more downside testing.