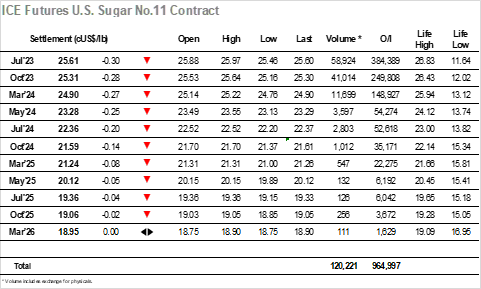

The past two days have seen some of the sheen removed from the market, the failure to challenge the contract highs and the six-week period remaining until the Jul’23 expiry both valid reasons for the apathy. Today’s session saw early volatility as opening losses were erased, though within an hour the market had again swung lower to be showing fresh session lows in the 25.60’s. This could easily have opened the floodgates to some technical weakness with limited support to be found ahead of this month’s lows at 24.88, but with day traders remaining quiet the market simply chose to work sideways, holding the 25.60’s through into the afternoon. A touch more movement did then follow with the market edging down through some consumer scale buying to reach 25.46, though still there was not the volume of selling needed to trigger off stops and set the price tumbling. The weakness did serve to draw out some spread selling however Jul/Ot’23 finally moving away from the 0.35-point area, slipping to lows at 0.28 points on the best volume seen for a while. The final two hours saw the price return to the 25.60 area, and with day traders now disinterested the day drifted to a quiet conclusion with Jul’23 settling at 25.61 to conclude a poor performance though one that changes little should the trade buyers return.

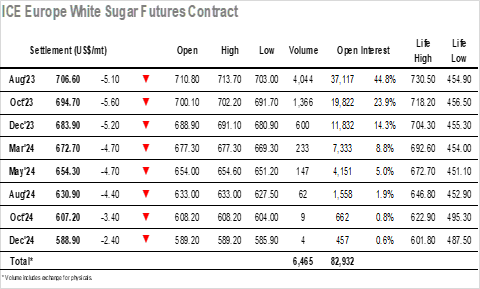

The whites market has proved a little more resilient than No.11 this week, but that could not stop prices from falling away this morning, and early high at $713.70 quickly forgotten as the price tumbled to $706.00. There has been some consumer buying interest in the $705/$700 band recently, and that interest was once more providing support as the market looked to dig in, holding a narrow band wither side of $705 for the rest of the morning on low volumes. There was no immediate increase in activities as the Americas traders joined the fray, though gradually a little more selling did arrive for Aug’23 with the market dipping to $703.00. This was the lowest price since 5th May, but with the underlying buyers still providing support the white premium values were increasing with Aug/Jul’23 trading beyond $112.00. Some short covering did pull values marginally away from the lows during the later afternoon, though having returned to the $706 area things settled down and the day petered out quietly, a closing value at $706.60 for Aug’23 leaving the market still rangebound for another day.